Asset Management Best Practice Guidelines (Version 2.0)

Do you prefer the guidelines as a pdf file?

Download PDFAre you interested in downloading a specific chapter?

Search the reports?

SearchCommercial and Financial Asset Management

Commercial and Financial Asset Management encompasses support activities for the best operation of a business. By definition, the scope of Commercial and Financial Asset Management goes from the contact with external entities on behalf of the Asset Owner until the conversion of operational data into useful and understandable financial information. It comprises the activities presented in this chapter.

7.1. Financial reporting

In addition to technical reporting (see section 6.1. Technical Reporting), financial information is incorporated into the individual monthly report that is usually centred in a cost structure analysis. The individual report should also include information regarding relevant operational incidents, corrective maintenance interventions and security incidents statuses (when provided by the O&M and security supplier).

An additional consolidated report may be produced. This document should include the information disclosed in the individual monthly reports (operational and financial), as well as a set of consolidated financial information with the purpose of providing an integrated portfolio vision. The following financial information should be included in the consolidated report:

- Consolidated financial statements (income statement: balance sheet and cash flow).

- Capital structure analysis.

- Detailed OPEX items or net financial expenses breaking down analysis by type of expense, comparing with previous homologous period (when available), and highlighting material contributions per cost figure.

- Profitability analysis.

- Cash flow overview (on a backward and forward-looking perspective).

- Debt compliance and follow-up – loan administration, including settlements supervision, supervision of interest rates fixing and remuneration of current accounts.

The focus of the Asset Manager is to monitor the business and provide recommendations for improvement of overall status and performance of the photovoltaic plant. By providing specialized management based on reporting individual and consolidated figures of the Asset Owner’s portfolio (portfolio perspective) and breaking down the contribution of each SPV to compare it with the financial model assumptions and historical years (whenever available), the Asset Manager is able to differentiate their service and add value to the Asset Owner. Such analysis will comprise a concise financial interpretation and understanding of the results, and such a periodic report may be fine-tuned in accordance with the Asset Owner’s needs.

The role of the Asset Manager includes the capability of contributing to the development of new indicators and of innovative reporting solutions. The Asset Manager may contribute significantly to the improvement of the performance of the photovoltaic plant by managing all the activities which have an impact and should be reported in the periodic financial reporting.

Furthermore, the Asset Manager is in charge of coordinating a set of corporate financial services that are essential to assess the economic and financial performance of the plant. These actions are relevant for the periodic financial reporting and should be previously agreed upon with the Asset Owner.

7.2. Strategy management

The business should develop and implement a strategic framework for all its Asset Management activities. It should be based upon the business strategy, future demand patterns, stakeholder concerns and asset-related risks. The output is an AM policy or future statement of intent, an AM strategy to achieve it, various AM plans and a scorecard of AM KPIs with improvement targets. This framework should be implemented with the required change management process and monitored through regular audits and management reviews.

7.3. Management of unsubsidised projects

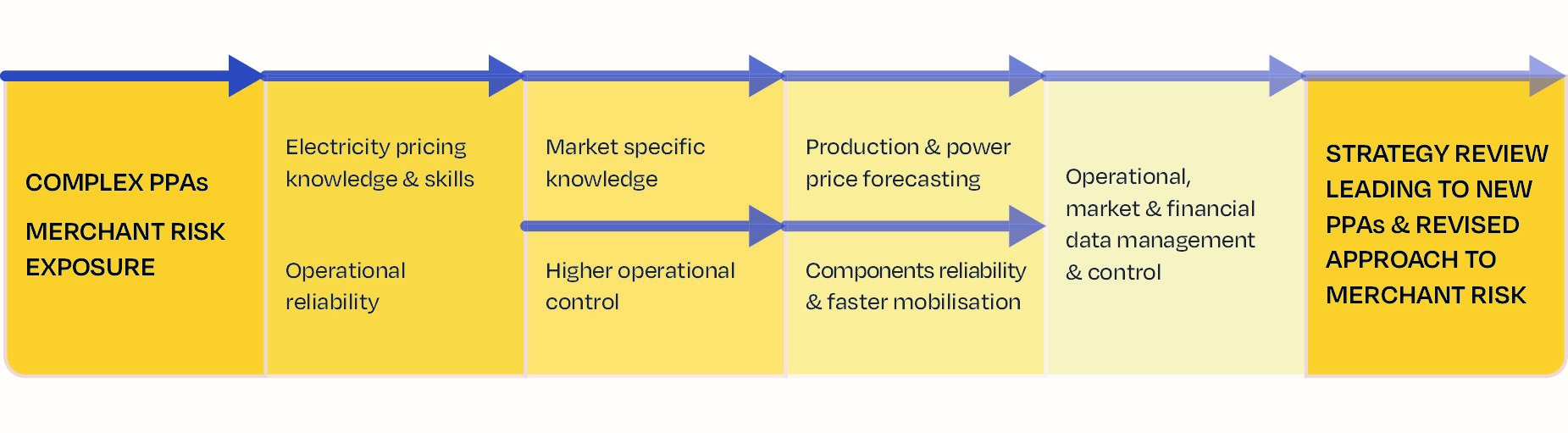

The solar PV industry is now at the dawn of subsidy-led market in multiple countries. The progressive reduction of subsidies and tariffs has naturally led asset owners to deploy more sophisticated revenues streams. We are therefore experiencing a substantial growth in the corporate PPA market, being these contracts physical (with private wire arrangements), virtual, sleeving and hedges. These comparatively new commercial arranges vary the risk profile of the PV plants from a counterparty and merchant risk exposure perspective, therefore it is vital to successful management of these contracts that Owners and AM service providers have developed and established data management tools and practices as described in Chapter 10 of these Guidelines.

If compared to a subsidy regime or a plain vanilla utility PPA, the corporate PPAs typically require an enhanced level of information undertakings from the part of the SPV and often a minimum level of operational and production reliability, leading to stricter requirements for response time and re-establishment of PV plant availability.

The introduction of contractually binding reliability requirements (such as a minimum production or volume (MWh) guarantee) and the exposure to merchant risk, represent a substantial shift in risk allocation toward the Owners. This therefore leads Owners and AM service providers to the necessity of new skills focused on electricity price market knowledge to facilitate forecasting, whilst reinforcing operational processes particularly with maintenance providers to ensure a low medium time to repair, and key components reliability to minimize mean time between failures. This is particularly affecting distributed generation, whilst larger scale sites which can afford to be regularly manned, seem to have a higher level of operational reliability due the higher response time to failures and downtime.

As the risk paradigm associated to the operation of the PV plants shifts toward the SPV and Owners, AM service providers must prepare and equip with the new skills set forth above also considering that these might have to be specific for each market they are providing services in. Given the high impact and frequency of these risks it is also expected that a number of Owners would explore the opportunity of internalising the strategic management of these contracts.

7.4. Corporate administrative services

The Asset Manager is usually in charge of providing corporate administrative services for the managed SPV, including coordination of the board of directors' meetings, and general management services, including domiciliation of the company, operation of the bank accounts etc.

7.5. Accounting

Accounting is the support area responsible for meeting local and international legal, regulatory and tax requirements as the reporting of financial transactions pertaining to business.

In Accounting, one must ensure that the local and international accounting standards (IAS) are met and align with the international financial reporting standards (IFRS) in order to produce financial information that is in a common global language for business affairs. This way, the accounts of a company are understandable and comparable across international boundaries.

Therefore, Accounting means processing all the financial information of a business and converting it into standardized outputs that are universally understood and comparable financial statements.

The Accounting service can be included in the Asset Management contract as a provided service regardless of whether it is an internalised (Asset Manager’s responsibility) or externalised (outsourced) service. The main activities under the scope of Accounting Services are detailed in section 7.7. Accounting assistance.

7.6. Customer relationship

The main customer of the Asset Manager is the Asset Owner. Consequently, all the third-party relationship management carried out by the Asset Manager must align with the Asset Owner’s work ethic, company culture, expectations and needs.

The Asset Manager is responsible for acting on behalf of the Asset Owner in all contact and relations with external entities (third-party) in accordance with the predefined Asset Management contract. The Asset Manager should source solutions, make negotiations and present all the collected information and its critical analysis to the Asset Owner for examination and for final decision-making.

The key customer of the SPV is the final recipient of the electricity generated by the photovoltaic plant, whether it is a local utility or a final consumer. The Asset Manager must: ensure compliance with the power purchase agreement, fulfil the contract requirements and deliverables, and verify if the settled tariff is being paid correctly. Furthermore, the Asset Manager is responsible for sourcing alternatives or renegotiating, when needed, the energy sale contract.

Thus, it is the Asset Manager’s responsibility to make the bridge between the Asset Owner and the SPV (Asset/photovoltaic plant) customers.

This requires a high level of responsibility, so the Asset Manager must be able to act promptly and effectively in the best interest of the Asset Owner at every instance.

Moreover, the Asset Manager should hold periodic meetings in order to inform the Asset Owner of the status of ongoing negotiations and other relevant events. The meeting and its agenda should be proposed by the Asset Manager.

Therefore, in order to streamline all relevant processes and to avoid any undesirable delays or missed deadlines, the Asset Manager is responsible for informing the Asset Owner of important correspondence, assuring maximum control of relevant external communications (local tax authorities, banks, suppliers and others).

Although the Asset Owner’s role is not to perform operational management activities, their awareness of relevant events happening inside the plant or in its immediate vicinity is of higher importance for their decision-making process.

In this respect, it is advised that the Asset Manager follows up relevant events with the help of a “Follow-up Report”. This document will assist in monitoring occurrences that may arise in the day-to-day operation of the project, as well as in tracking serious issues and establishing action plans and priorities.

7.7. Accounting assistance

The Accounting Service is obliged to comply with local and international legal, regulatory and tax requirements in accordance with the IAS and IFRS, as mentioned in section 7.1. Financial reporting,7.5. Accounting and 7.6. Customer relationship. Therefore, establishing processes and procedures in order to have a complete understanding of the local legal, regulatory and tax requirements applicable to the reporting of financial transactions pertaining business should be done accordingly. Consequently, the Asset Manager should be supported by an Accounting Service that is knowledgeable in local market practices.

The Asset Manager ensures that the Accounting Service meets its obligations of Book-keeping and Administration as well as Accounting Procedures. Monthly and annual activities of the Accounting Service are stated below.

Book-keeping and Administration

- Registration of book-keeping entries for the project company’s operations.

- Keeping the project company’s accounting books (general ledger, VAT registers, inventory book and depreciable assets book).

- Calculation and entering of the corresponding amortisation allowances into the project company’s books and keeping a complete record of all fixed asset balances.

- Calculation and entering of remittances, where applicable, into the project company’s books.

- Registration of the project company’s financial operations.

- Registration of time period adjustments (accruals and prepayments, including interest accruals) in the project company’s accounting books.

- Management of the project company’s correspondence.

Accounting procedures

- Establishment of Accounting and Administrative procedures.

- Preparation and assistance during tax audits.

- Preparation of monthly financial statements (balance sheet and income statement) of the project company.

- Advise on financial and accounting matters in the daily operations and matters that may impact the accounting operation of the project company.

- Elaboration of the project company’s statutory annual accounts.

Furthermore, the main outputs of the Accounting Service include the elaboration of the SPV’s (asset/PV plant) statutory annual accounts, general ledger listings, accurate financial statements (balance sheet and income statement), and the design of an appropriate chart of accounts or analytical accounting issues namely, with regards to a portfolio, to ensure the correct allocation of income and expenses across the PV plant(s).

7.8. Invoicing/billing and payments

An invoice is a commercial document that itemises a transaction between a buyer and a seller. If goods or services were purchased on credit, the invoice usually specifies the terms of the deal, and provides information on the available methods of payment. An invoice is also known as a bill or sales invoice.

Therefore, the invoice is the most important document for the Asset Manager to control the revenue. It allows the Asset Manager to verify if the invoiced amount is in accordance with the produced energy amount. This is the first step to control the SPV’s income. As a note, the invoice is a key document to control costs. The Asset Manager must ensure that all suppliers’ invoices are consistent with what was agreed in the service providers’ contracts.

One can consider that the biggest challenge of the Asset Manager is the control of revenues and expenses through rigorous invoicing monitoring.

7.9. Revenue control

The Asset Manager is responsible for confirming the reading of the meters based on the information collected on site by the O&M Team, and for validating and comparing it with the billing issued by the electricity purchaser. These activities are called Revenue Control and include:

- Calculation of revenue corresponding to energy generation using the production data downloaded from the production meters.

- Verification of the production data read and registered as well as the issuance of relevant invoices and self-billing invoices, if applicable.

- In case differences occur between the actual energy produced and the energy registered, processing of the corresponding claims and following up until the claims are completely resolved.

- If incidences that arose affected the reading of production meters, coordination of necessary actions to guarantee the accurate invoicing of the energy fed into the grid.

7.10. Cash flow management

The Asset Manager is responsible for managing the treasury activities and for monitoring the cash available in every period. Cash management is crucial for the expenditures’ decision-making process. The Asset Manager is accountable for ensuring the proper balance between income and expenses plus revenue and cost.

Adequate treasury operation allows the Asset Manager to manage and adjust payment dates in accordance with the predicted income dates. This way, the expenses can be incurred at a more appropriate timing.

Moreover, the cash flow management gains importance when one considers the variability of the revenues of a PV plant. The latter depends on:

- Weather conditions.

- Equipment status and performance.

- Tariff nature (fixed vs. variable)

- Local tariff legislation and contract in place (FiT, PPA, Pool Price).

The cost structure of a solar power plant has the opposite behaviour, which is relatively stable throughout the lifetime of the project. The highest costs are associated with operational contracts, such as Operation and Maintenance, Land Lease agreement, Asset Management and Debt Financing. These contracts are not usually negotiated by the Asset Manager as they are typically long-term, entered by the Asset Owner and sometimes tied to Project Finance terms. However, for lighter costs, such as insurance policies, communications, independent audits and security, the Asset Manager is in a position to negotiate and should strive for continuous improvement and optimisation, not only in terms of cost, but also in terms of quality of services.

The opposite behaviour of revenues and costs highlights the complexity of ensuring a stable monthly balance between them. For instance, if the monthly revenue is far below the forecast due to a decrease in the monthly irradiation levels, it may represent a risk of a decrease in liquidity for the SPV (photovoltaic plant), especially if significant expenses are required in this specific month.

An additional challenge to cash management is the few degrees of freedom the Asset Manager has to influence cash flows: Inflow of cash is dependent on external or random events as described above, whereas outflows are mostly fixed in long-term contracts. The single most powerful lever for ensuring liquidity is determining the appropriate level of investor dividends. In most cases the amount of cash paid out in an annual dividend payment model directly determines the level of cash available for the next 12 months.

Imminent to the nature of a PV plant is a 12-month cycle in cash flows, with shorter cycles of cash balance minima at times, when low production periods coincide with debt repayment (typically around March/April in the Northern Hemisphere). To continuously ensure sufficient cash balance, the Asset Manager needs a rolling cash flow model at least for the following 12 months. Extending the rolling forecast period to 18 months provides additional security and comfort to the Asset Owner.

Dividend calculation therefore should not only take into account the constraints posed on cash flow management by financing schemes (covenants) and investor expectations, but also the expected cash balance of the liquidity planning cycle.

Concluding, cash management is a crucial part of the scope of work of the Asset Manager.

From a cash management perspective, the Asset Manager is responsible for:

- Managing accounts payable/receivable (providing notice to the Asset Owner for authorisation of payments).

- Repayments of shareholder loans (interest and principal) and any other distributions to SPV’s shareholders.

- Cash flow statement (forecast vs. actual).

- Payments under SPV’s contracts (O&M, surveillance, land lease, security, monitoring and others).

- Repayments of shareholder loans (interest and principal) and within other financing schemes, as well as any other distributions of the SPV’s shareholders.

- Validation (of interest and other bank charges).

7.11. Working capital reconciliation

The revenue stream of a solar power plant is variable due to the indexation of electricity production that is mainly dependent on the weather. However, the cost structure is relatively stable. Taking that into consideration, the need for close monitoring of accounts payable and accounts receivable assumes a higher importance.

Therefore, the Asset Manager should manage accounts payable and accounts receivable through rigorous client and supplier contract negotiation, ensures that the days payable outstanding are convenient to the SPV, according to the days receivable outstanding. The days receivable outstanding should be lower than the days payable outstanding in order to ensure that the accumulated revenue generated is enough to meet the supplier’s payment (to guarantee proper availability of the cash short-term). Furthermore, in order to stabilise the revenue stream when unpredictable events happen (for example, machinery breakdown) resulting in downtime, the Asset Manager must ensure that response times of the O&M contract are being respected. Hence, it is the Asset Manager’s responsibility to guarantee a close monitoring of revenue stream, working capital and cash flow variations.

7.12. Financial control

Financial control is the set of processes, policies and procedures which enable the analysis of a company’s actual activities from different perspectives at different times, compared to its short, medium- and long-term objectives and business plan. This analysis requires control and adjustment to ensure compliance with the business plan and in the event of anomalies, irregularities or unforeseen changes. The Asset Manager is responsible for conducting such analysis in order to achieve the company’s performance optimisation and the company’s financial goals.

Financial control processes, policies and procedures must be defined according with local and international legal, regulatory and tax requirements, the Asset Managers’ experience and shareholders’ remuneration. There are different types of financial control processes and procedures, such as accounting standards, financial statements (balance sheet, income statement, cash-flow statement, statement of changes in equity), budgets, business plans, operating metrics (such as profit margins, KPIs), and external financial audits, as well as different types of policies regarding general ledger, chart of accounts, recognition of revenue, reconciliations, invoicing, payment processing, inventory, among others. The job of the Asset Manager is to ensure the SPV compliance with the defined financial control processes, policies and procedures through coordination with the teams involved (Accounting Department, Treasury Department, Tax Consultant).

The Asset Manager oversees the preparation of the annual budget forecast and updates it with actual data, analysing the deviation between the forecast and actual data. The budget forecast should be validated by the Asset Owner and used as a comparison (to the actual data) in the corresponding periodic financial reporting.

The annual budget forecast includes:

- Monthly estimation of OPEX

- Monthly estimation of production and revenues, according to the technical data or project finance

- Financial expenses

- Taxes

- Tangible fixed assets depreciation costs.

Adequate interpretation of the current year’s activity will allow the Asset Manager to adopt higher levels of certainty when elaborating the budget forecast for the following year, thus being more accurate in terms of predicting the financial efficiency of the project.

In order to complement the micro-level analysis for the upcoming year (budget), the Asset Manager should analyse the SPV’s Business Plan in order to understand if the business’ actual data is aligned with assumptions considered in the Business Plan or if there are any deviations. Should deviations happen, the Asset Manager must propose and define a strategy, along with the Asset Owner, to overcome them. The business plan is often elaborated by the Asset Owner or by the Asset Owner’s Financial Consultants.

As a final step to ensure proper financial control, the Asset Manager should advise the Asset Owner on the need to contract an external auditor to certify the accounts and to approve the annual accounts and report. The Asset Manager should assist the auditing team.

7.13. Contract management (financial contracts)

Contract management encompasses both technical and commercial/financial aspects. This section looks at contract management from a commercial/financial AM point of view. Section 6.7. Contract management (operational contracts) takes the perspective of the Technical Asset Manager.

The Commercial/Financial Asset Manager is responsible for the sourcing of service providers, contract optimisation, supervising contract compliance, relationship management, liaising with suppliers in case of non-compliance or claims, as well as coordinating with other entities.

Also, contracts not managed by the Technical Asset Management, such as FiT and PPAs, and any other support scheme reporting and accounting are managed directly by the Commercial/Financial Asset Manager due to their financial requirements and contract deliverables.

The Asset Manager must regularly conduct a comprehensive review of all contracts concluded and record them in a relevant document or software: the start and end date of the contracts, actions and deliverables (what, when and how) that must take place in order to ensure contract compliance, prices indexation and updates, the type of payment and payment dates, requirements for notification of termination of the contract, indexation to other contracts, services provided, breaches of the contract, and useful information. This will provide the Asset Manager with the proper information to manage, negotiate and comply with the contracts and their requirements. It is imperative to ensure that the contract requirements and periodic deliverables are met in a timely manner to avoid contractual penalties and therefore unforeseen expenses.

Whenever necessary and possible, the Asset Manager should actively identify and solicit alternative service providers to guarantee contract optimisation in terms of conditions, price, service and quality. (For more information, see also chapter 8. Procurement).

When it comes to PPA management, the Asset Manager should always consider the financial soundness of the counterparty, the transparency, and bankability of the contract by relying on rating reports, financial statements and warranties provided.

Contract management is a very time-consuming element of business and automation of the contract management system is an efficient tool to save time and costs allowing the allocation of resources to other pending matters.

7.14. Suppliers account management

In sections 6.7. and 7.13. on Contract management we explore the Asset Manager’s role in operational and financial contract management, contractual requirements compliance, contract monitoring and contract optimisation and negotiation. In the present topic we will emphasise the importance of regular activities performed by the Asset Manager such as: monitoring of the operational contract execution, relationship management, event accessing, decision-making and administrative management (for instance, following up an insurance claim), and evaluating financial impacts (for instance, extracontractual O&M activities).

The Asset Manager is responsible for sourcing, evaluating the financial impact, negotiating, managing and ensuring the execution of all supplier contracts. Moreover, in the occurrence of an abnormal event, it is the Asset Manager’s obligation to assess whether this event is or is not extracontractual, estimate damages and financial impact, find the adequate solution and perform the necessary administrative tasks in order to quickly establish normality in the business. Lastly, throughout the process, the Asset Manager should report to the Asset Owner.

The Asset Manager is a key player in suppliers relationship management. By having a 360º perspective of the operational business, financial performance and the supplier’s contracts in place, the Asset Manager can add value by deeply understanding the project’s needs and by trying to get individual contracts in order to ensure maximum business optimisation. It is hard to assess business improvements achieved by an experienced Asset Manager, as they go far beyond easily measured quantitative financial improvements. For more details on supplier categories and selection, see chapter 8. Procurement.

In order to clarify what the Asset Manager’s role in supplier account management is, please refer below to the most important suppliers.

O&M Suppliers

Throughout the operation phase, the main task of the Asset Manager is to supervise the O&M supplier in terms of compliance with contractual obligations such as O&M Team response times. In addition, the Asset Manager is also responsible for validating the compliance of the contracted O&M preventive maintenance plan and coordinate corrective maintenance activities.

Furthermore, depending on the type of activities assigned to the O&M Service contract, the Asset Manager may also supervise the contractual compliance related to warranties and processing of necessary claims, if applicable.

Another important role of the Asset Manager is to monitor the additional O&M services not included in the O&M contract and therefore representing additional cost for the Asset Owner and affecting the project cash flow. From this perspective, the Asset Manager is responsible for assessing the operational impact reported by the O&M provider and for evaluating the suitability and necessity of the activities.

In some cases, when specific extra works are frequently executed, representing a high weight on total OPEX costs, this may be a good opportunity to assess the O&M contract and propose to the Asset Owner a revision of the O&M contract to include the referred works under the scope of the contract.

Landowners

The land lease agreement is a long-term contract and it is one of the most important contracts in the solar power generation business. This agreement ensures that the PV Plant can be installed and can be in operation during the asset lifetime (30+ years) on the chosen land. Usually the land lease agreement is negotiated and secured by the development team before the construction phase and can be a contract signed with more than one landowner (if the chosen place to install the PV plant belongs to more than one landowner).

Therefore, the Asset Manager is responsible for managing the land lease contract made between the SPV (special purpose vehicle) and the Asset Owner. This means that the Asset Manager is responsible for:

- Managing a key long-term relationship ensuring good relations between the landowner and the Asset Owner.

- Assessing the land lease’s annual price indexation.

- Solving land lease agreement problems: for instance vegetation control issues (for instance disputes with neighbours in case of shared vegetation), manage PV plant access, inform land owner of alterations needed in the PV plant (for instance, DNO access to alter type communications), among others.

- Comply with local legislation with regards to land alterations (planning permit).

- Renegotiate contract extension if needed.

Such efforts shall comprise the procurement of technical and economical solutions and the contractual arrangements and subsequent implementation of the solution previously agreed upon with the Asset Owner.

Insurance

The Asset Manager is responsible for managing the insurance contracts made between the Asset Owner and the Insurance Company.

This means that the Asset Manager is responsible not only for the annual assessment of insured capitals and coverages depending on the evolution of market prices, but also for coordinating insurance claims and the subsequent review of claims with parties involved (Broker, Loss Adjuster, O&M supplier, security company and others).

In case of damages to the Asset which could be covered by the insurance policy, the Asset Manager will work with all parties involved to:

- Ensure the necessary contacts with insurance companies/brokers to guarantee that the operation is restored as soon as possible.

- Ensure adequate indemnities are paid in accordance with the policy conditions.

- Assist the Asset Owner with the execution of insurance contracts and their compliance with the established requirements.

- Ensure that the information required to file the claim (including material damages, business interruption and machinery breakdown) is gathered and submitted to the insurance broker and loss adjusters.

Such efforts shall comprise the procurement of technical and economical solutions and the contractual arrangements and subsequent implementation of the solution previously agreed upon with the Asset Owner.

Security services and surveillance system management

On the one hand, the Asset Manager acts on behalf of the Asset Owner on the procurement and contracting of specialised security services, including, amongst other things, daily interaction with customers, as well as with specialised suppliers (e.g. remote CCTV/alarm filtering and monitoring agreements, mobile response and on-site presence handling) in order to advise on the most suitable solutions available in the market.

On the other hand, the Asset Manager provides clear communication and dispatching protocol in accordance with the terms and conditions set forth by the Asset Manager and gathers business intelligence data on incidents and abnormal operating conditions from a security management perspective. Security information is also included in the Asset Management periodic financial reporting.

Technical consultancy

The Asset Manager acts as the interface and support for external organisations on behalf of the Asset Owner (e.g. operational assessment and technical risk analysis), available on demand, according to the rates agreed upon, as an additional service.

Throughout the operation phase, the Asset Manager may make regular periodic visits to the plants. Depending on the performance, operations, maintenance or insurance claims that may take place related to the plant, the Asset Manager may carry out additional site visits, in order to investigate specific circumstances at the request of the Asset Owner.

The Asset Manager is expected to provide recommendations on the best certified suppliers and specialised technical inspections and consultancy services.

At this level, the Asset Manager develops an integrated approach to risk management, including the development of initiatives for risk mitigation.

Legal consultancy

The Asset Manager will be an interface with the Asset Owner’s legal advisors, focused on providing effective and timely assistance and on setting forth a thorough description and understanding of requirements or feedback from legal support.

This role is very challenging and can only be met by wide knowledge of the best legal players and practices in the renewable energy sector (e.g. lawyers and consultants), as well as a deep understanding of the Asset Owner’s approach, needs, industry and market.

Whenever the complexity of any legal matter requires external, specialised advice, the Asset Manager will discuss this in advance with the Asset Owner.

Audit and Consultant Services

Whenever necessary, the Asset Manager assists the Asset Owner’s financial auditors and other advisors, especially in conducting annual financial audits, including the processing of ‘Prepared by Client’ lists, assisting the auditors in working meetings, collecting information from the Client and updating the audit progress.

The following activities are considered as an example of the relationship and interdependency between the Asset Manager and the external auditors:

- Monitoring and supporting of financial statements (Local GAAP and/or IFRS) and submission of all tax returns.

- Advice on financial and accounting matters in the daily operations and situations that may have an impact on the accounting situation of the SPV.

- Management of the relationship with the project company’s external auditors (if applicable), using best efforts so that the project companies receive audited financial statements within the established deadline: the year following the reference fiscal year.

Finally, the Asset Manager should advise the Asset Owner on the need to hire an external auditor for certifying the accounts and approving the annual accounts and report.

Electricity providers

Throughout the operational phase, the PV plant needs electricity to power auxiliary services and/or ancillary services. Auxiliary services are the services that affect production (e.g. inverters) and ancillary services are the services that are not directly linked with solar power production (e.g. CCTV system, monitoring system, illumination, among others). Electricity provision can be achieved in two ways: having an electricity supplier or using the electricity generated from the PV plant. The latter option is not always achievable due to size constrains of the PV plant.

It is important to secure a good electricity supplier since it can affect the PV plant’s core business, electricity generation. Moreover, solar power plants with storage, which will be increasingly common in the future, will need a higher stable energy stream to function properly.

The Asset Manager is responsible for negotiating and managing the electricity supplier’s contract established between the SPV and the supplier. This means that the Asset Manager is responsible for:

- Managing the long-term relationship between the Asset Owner and the service provider;

- Assessing and negotiating the annual price indexation;

- Renegotiating contract extension if needed.

7.15. Supplier penalties invoicing

It is not uncommon for EPC and O&M contracts to include penalty clauses linked to specific KPIs to protect the asset owner’s interests.

EPC contracts typically include penalty clauses for the first few years of asset operation. Underlying KPIs are highly individual and may include plant PR, plant availability, grid connection date and deadlines for completing punch list items, among others. The responsibility for tracking these KPIs and managing corresponding payments may be transferred to the Asset Manager. In this case, detailed knowledge of the EPC contract and information on any funds withheld by the SPV is crucial.

Likewise, O&M contracts may include bonus or penalty mechanisms linked to KPIs such as PR, plant availability and reaction times, among others. In case of bonus payments, the Asset Manager needs to make suitable provisions in the financial planning. In case of penalties, the Asset Manager needs to calculate and invoice the penalty amounts to the O&M provider.

7.16. Interface with banks and investors

A photovoltaic plant is considered an infrastructure investment, thus one that requires high capital volume during the construction phase and low capital volume during the operation phase. Project finance is the most common source of financing for infrastructure projects. Project finance creates value by reducing the costs of funding, maintaining the sponsors’ financial flexibility, increasing the leverage ratios, avoiding contamination risk, reducing corporate taxes, improving risk management, and reducing the costs associated with market imperfections. Therefore, project financing is a loan structure that relies primarily on the project's cash flow for repayment, with the project's assets, rights, and interests held as secondary collateral. Project finance is especially attractive to the private sector because companies can fund major projects off balance sheet. Usually the sponsors are bank consortia. A PV plant is only rarely financed by a regular commercial bank loan.

Nevertheless, project finance is a very demanding type of financing and entitles a long list of requirements and periodic deliverables that usually come with a heavy set of penalties when not complied with.

The Asset Manager is responsible for having a comprehensive understanding of the financing contract in order to ensure that the periodic deliverables and requirements are met meaning that the Asset Manager assures the elaboration of all the documentation needed to comply with the financing contract requirements. Thus, the Asset Manager is responsible for the elaboration of bank periodic reporting, financial statements, coverage ratio monitoring, escrow accounts monitoring and business plan updates, among other requirements. Additionally, the Asset Manager is responsible for monitoring the non-financing contracts that are indexed to and locked by the project finance (usually land lease, Operation and Maintenance, security).

Although this generally represents a high workload for the Asset Manager, it is their responsibility to avoid penalties raised by contract non-compliance.

7.17. Equity/debt financing management

With regards to funding an infrastructure investment, an alternative to project finance is equity investing (investment funds, private equity firms, private investors and SPV’s holding company equity, among others). Usually, a project is not entirely equity financed; in reality, the Asset Owner can opt for a mix between equity and debt.

The Asset Manager is responsible for having a comprehensive understanding of the equity agreement and the bank loan requirements in order to work for the SPV’s maximum optimisation and profitability, maximising shareholder remuneration and complying with debt service. As stated in section 7.10. Cash flow management assumes an important role to ensure liquidity to comply with debt service schedule. Therefore, the Asset Manager is responsible for loan administration (including settlements and contracted interest rates supervision, debt service coverage, and compliance with requirements and deliverables, among other administrative tasks).

This type of funding is less demanding and has less deliverables, as its periodic reporting is usually less rigorous and aligned with the Asset Management monthly reporting.

Solar PV assets are increasingly re-financed during the operational phase, allowing the owners to benefit from more stabilised operations and a lower operational risk profile, leading to better lending terms. In these circumstances, the Asset Manager can provide additional services and support to the owners by feeding the refinancing due diligence process facilitating the collection of site information and documentation, as well as lead the discussion with technical and other advisors.

7.18. Tax preparation, filing and administration

The Tax Management Service includes tax preparation, filing and administration and can be included in the Asset Management contract.

The Tax Management Service is obliged to comply with local and international legal, regulatory and tax requirements. Therefore, a comprehensive understanding of these requirements is indispensable.

The Asset Manager is responsible for coordinating the work between the Accounting and Tax Service, complying with local tax authorities, providing simple tax support and ensuring payment of taxes, and checking if the deliverables required by the local tax authority are met. Moreover, the Asset Manager is accountable for reporting all regular and relevant information to the Asset Owner. Besides management support, the added value provided by the Asset Manager is a deep knowledge of the solar industry together with a critical analysis of the local tax authority’s requests, given the financial environment. This could result in distinctive tax legislation interpretations which could have tax exemption as an outcome. Consequently, a positive effect on the SPV’s profitability is generated.

Therefore, the Asset Manager conducts regular tax activities such as the preparation and filling of relevant tax returns (CIT, VAT, Stamp Duty, withholding taxes, among others) as well as the handling of tax authorities’ correspondence and requests. However, whenever in the presence of unconventional or irregular situations, the Asset Manager should delegate the responsibility to an external local Tax Consultant, as specific expertise and a certified worker are both required. The Asset Manager becomes responsible for providing the Tax Consultant with all the necessary SPV documentation.

A short reference of the tax management activities is presented below.

Tax management

- Regulatory compliance oversight related to tax obligations

- Calculation and filing of the project companies’ tax declarations

- Handling Corporate Tax

- VAT (registering, periodic filing and refund requests)

- Handling Property Tax

- Handling Withholding Tax

- Processing of tax payments

- Control of tax refunds

- Direct relationship with Tax Authorities.

7.19. Challenges of multi-jurisdictional and global portfolios

The principles of a sound Commercial and Financial Asset management are constant and should be deployed consistently across markets and jurisdiction to ensure efficiency and effectiveness of management as well as facilitate operational control and consolidation. However, the key tasks carried out as part of the Commercial and Financial Asset management require partial adaptation to the peculiarities of different markets and jurisdictions.

| COMMERCIAL AND FINANCIAL AM ACTIVITIES | MULTI-JURISDICTIONAL CHALLENGES |

| Financial reporting | For AM service providers with well-established data management and reporting practice (e.g. standardised budget codes), the location of sites in multiple and different jurisdiction should be essentially neutral. Aggregation of sites and data might be developed to assist the Owner preferred view of the international portfolio, but adjustments will need to be made for local currencies. Adjustments may also need to be made for different accounting standards. |

| Strategy management | A global strategy will need to be adapted to local laws and regulations. |

| Management of unsubsidised projects | More sophisticated Corporate PPA’s and sales on electricity markets can be coordinated globally but require local expertise and management. Standardised invoicing tools and Energy Trading Risk Management Systems (ETRM) may be global to allow some harmonization for a global portfolio but local electricity market rules and regulations will require local solutions as well. |

| Corporate administrative services | This requires strong support from the legal function and depends on local Company law rules (articles of association etc). Shareholder Agreements may equally specify different obligations depending on what has been agreed. |

| Accounting | A key challenge is ensuring harmonization with local and international (IFRS) accounting standards). |

| Customer relationship | Asset Owners globally may have different ethics, cultures expectations and needs so a global portfolio with many different Asset Owners will need to adapt to this. |

| Accounting assistance | Harmonisation is key and standardised budget / accounting codes is critical for this purpose. |

| Invoicing/billing and payments | Driven by the contractual terms for each contract whether it be a revenue or cost for the SPV. Global IT solutions (Asset Management software, Enterprise Resource Management System) can support a global approach and allow easier aggregation of data for reporting purposes. |

| Revenue control | Can be very local depending on the electricity market rules in the country or region concerned. The Asset Manager may not always have access to the electricity meter directly and may be reliant on the grid operator to send the information for billing. Global IT solutions can again support revenue control and allow better checks of the data provided by a grid operator. |

| Cash flow management | A global Enterprise Resource Management System can support a global portfolio as well as global treasury software solutions for making payments. |

| Working capital reconciliation | As above. |

| Financial control | Good procedures and tools can help ensure the effective financial control of a global portfolio of assets. |

| Contract management (financial contracts) | This will depend on the content of the contracts but it is important to have a global database of key terms and obligations. |

| Suppliers account management | As above. |

| Suppliers penalties invoicing | A global asset supervision tool can ensure a global approach – good quality base data is key for these calculations which can often be set up directly I the supervision tool to avoid errors and ensure consistency of the calculation. |

| Interface with banks and investors | Infrastructure investors and banks are often present in multiple jurisdictions and require a single harmonized approach to reporting and communication. |

| Equity/debt financing management | This will depend on the content of the contracts but it is important to have a global database of key terms and obligations. |

| Tax preparation, filing and administration | A key challenge is local tax rules and regulations but principles may be similar. |

TABLE 13 - COMMERCIAL AND FINANCIAL ASSET MANAGEMENT: CHALLENGES OF MULTI-JURISDICTIONAL AND GLOBAL PORTFOLIOS