Asset Management Best Practice Guidelines (Version 2.0)

Do you prefer the guidelines as a pdf file?

Download PDFAre you interested in downloading a specific chapter?

Search the reports?

SearchKey Performance Indicators

The baseline of the Asset Manager’s work is confidence. The Asset Owner trusts the Asset Manager to manage their asset, assuring the best operational performance and financial optimisation. For that, the Asset Manager should outline effective, rigorous and well-defined processes and procedures according to each geography’s needs. This will ensure that the Asset Manager complies with the best guidelines and working practices for daily customer-oriented work.

Close monitoring of Asset Management procedures is required to ensure the effectiveness and efficiency of AM service provision. This can be achieved through the definition of clear and objective KPIs which need to be continuously assessed.

The benefit of using solid and high-standard KPIs to assess performance is assuring the quality and stability of the Asset Manager work. This enables the Asset Manager to monitor their work and learn through experience in order to evolve continuously, which translates into providing a high-quality service for the Asset Owner.

The following sections present the most important KPIs to measure the performance of Asset Managers. (Note that the KPIs used by the Asset Manager to evaluate suppliers are presented in chapter 8. Procurement).

11.1. Asset Manager experience

The Asset Manager’s track record and experience can be very important to enable the identification of critical subjects or situations lacking intervention – which translates into work efficiency, based on organising and prioritising the most urgent subjects. Additionally, the return of experience has an important role in the creation and/or redefinition of Asset Management procedures. The Asset Manager’s experience can be quantified by indicators such as the number of tender processes managed, OPEX reduction achieved and historical KPI of the key suppliers.

11.2. Quality of service based on periodic Asset Owner surveys

It is important to obtain Asset Owner’s feedback to understand if the Asset Manager’s work is aligned with the Asset Owner’s needs. This can be achieved through the elaboration of periodic surveys. This helps the Asset Manager to identify critical areas of the Asset Management’s process and to define different operating strategies, in accordance with market trends or technological innovations, to be more effective.

11.3. Reports Compliance Rate (RCR)

This KPI is intended to measure the capability of delivering the periodic reports to the Asset Owner on time. Periodic reporting is the most important responsibility of the Asset Manager’s work, because it is the most comprehensive way to deliver the operational and financial position of the PV Plant or Portfolio to the Asset Owner on time.

Therefore, it is imperative to monitor this indicator closely and continuously.

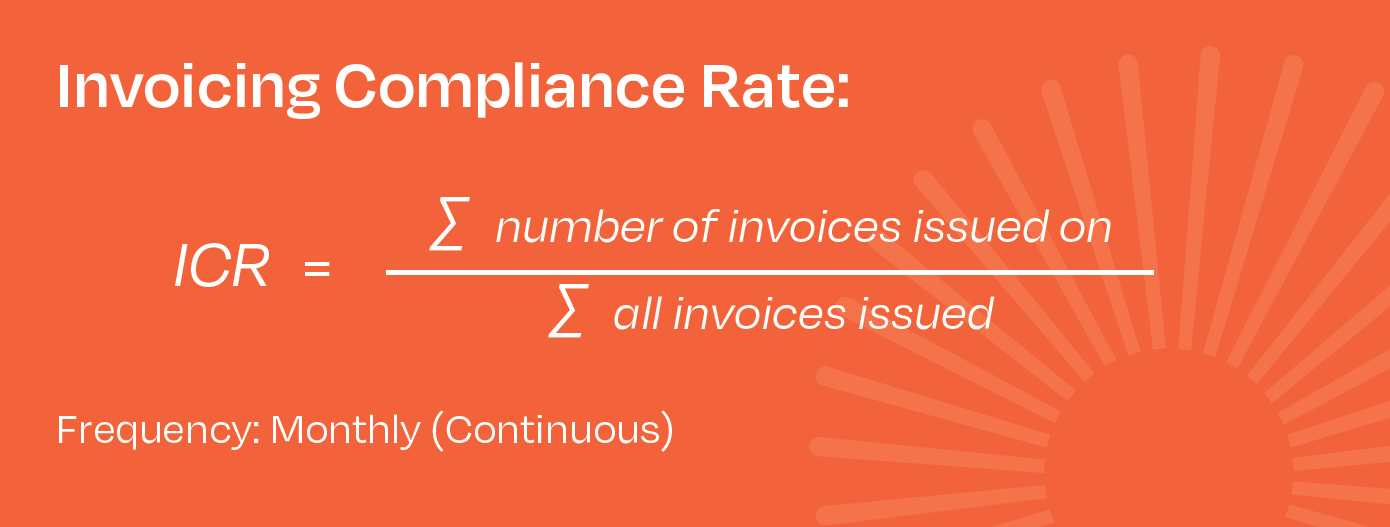

11.4. Invoicing Compliance Rate (ICR)

This KPI is intended to measure the capability of issuing the invoices to the Asset Owner on time.

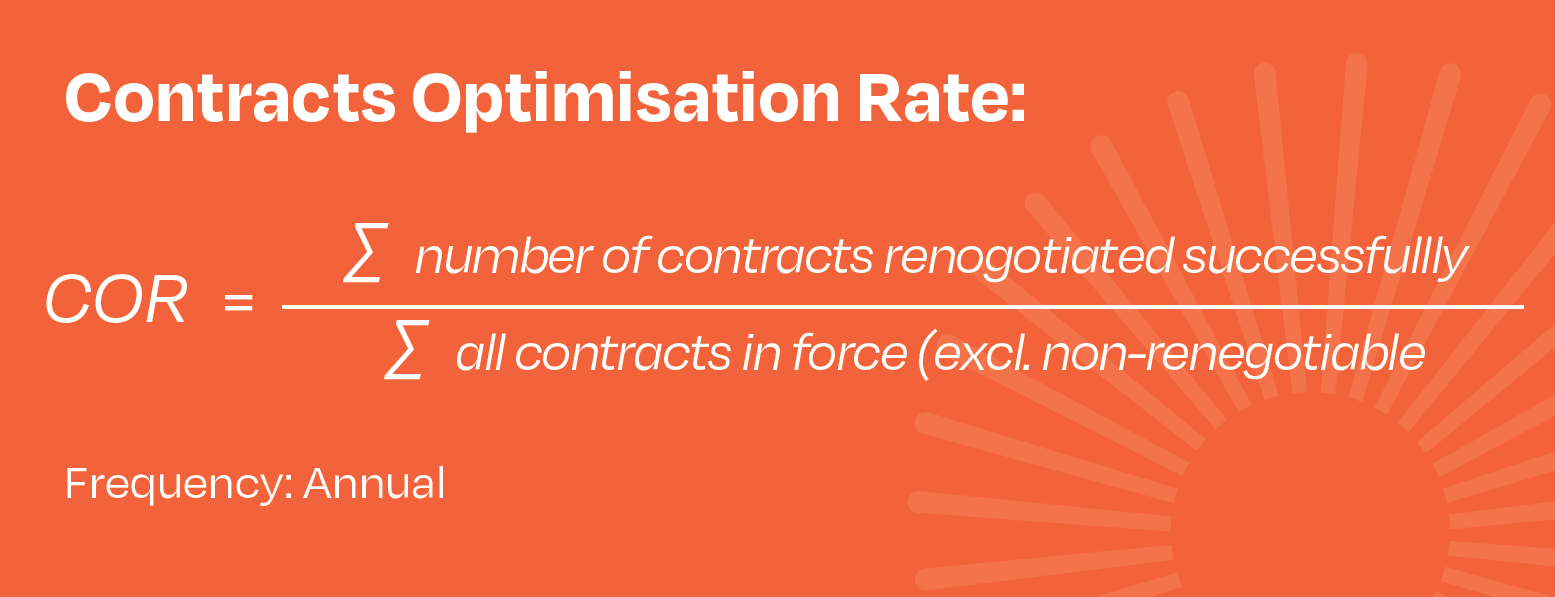

11.5. Contracts Optimisation Rate (COR)

This indicator is relevant to assess the Asset Management work of optimising the asset’s cost structure and quality of service. COR KPI measures contracts’ optimisations.

However, this indicator should be analysed carefully depending on the assumptions considered by the Asset Manager. This means that it is necessary to understand the computation of this indicator in order to make assertive/valid conclusions.

There are contracts that cannot be renegotiated by the Asset Manager either because they are locked by project finance requirements or they are initially negotiated for long periods based on an annual fixed fee and indexed to annual CPI. Usually, these contracts represent about 70 – 80% of the OPEX costs – predicted in the KPI’s denominator. For example, Land Lease, Asset Management and O&M.

Although the number of renegotiable contracts has a residual weight in the OPEX structure, they should be reviewed annually to achieve global contract optimisation.

Nevertheless, from the Asset Owner’s perspective, the most important thing is to achieve a COR > 0%, meaning that the Asset Manager was able to optimise one or more contracts (which is always positive) no matter how small the saving(s) was (were).

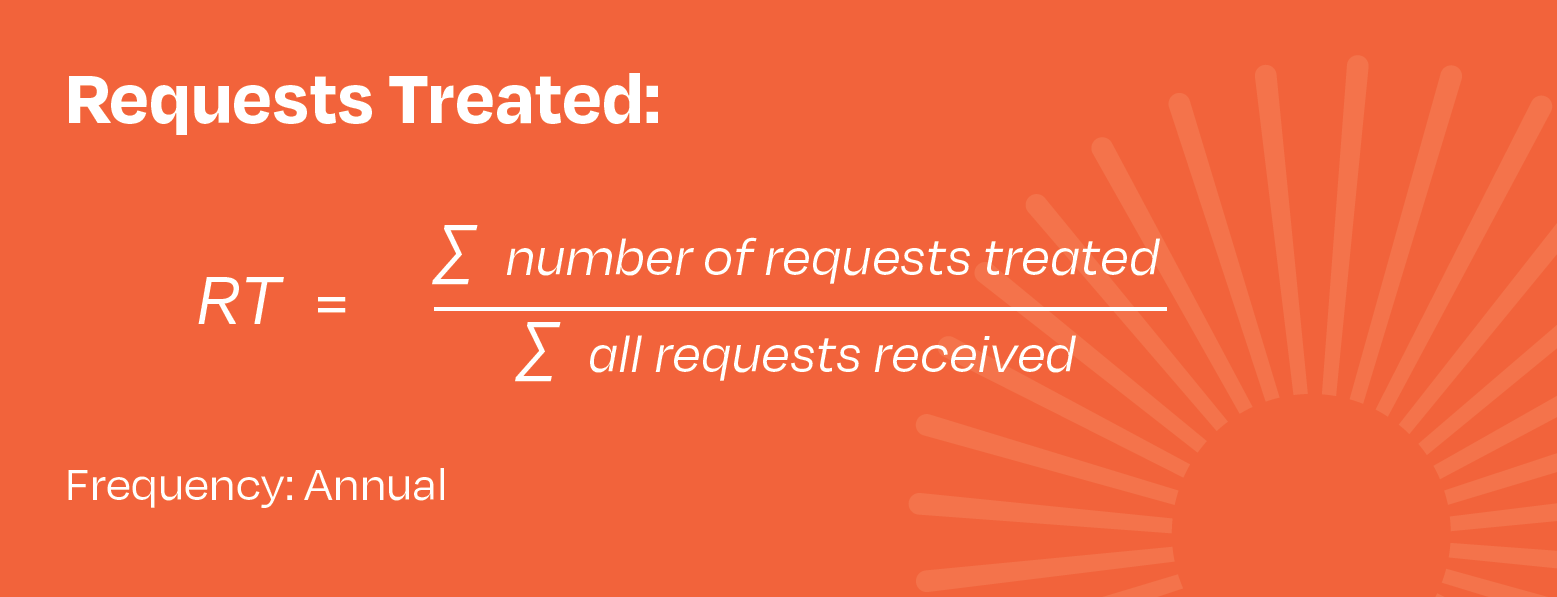

11.6. Requests Treated (RT)

RT indicator is intended to assess the Asset Manager’s efficiency during a specific period.

This KPI is to assess Asset Manager performance level, based on the number of replied requests. Additionally, it allows the Asset Manager to identify which requests were not followed-up.

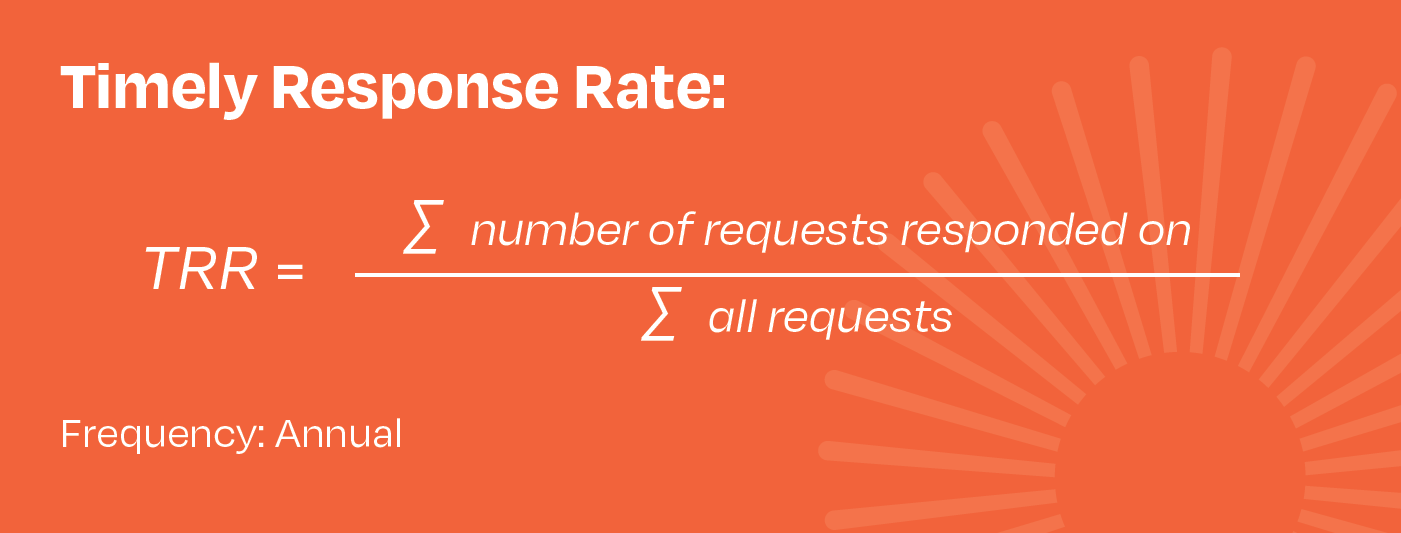

11.7. Timely Response Rate (TRT)

Response Time is useful to monitor the compliance of contractual deadlines. As mentioned above, periodic reporting is one of the most important deliverables under the scope of the AM contract.

This indicator is useful to identify weaknesses and strengths in the Asset Management procedures.

11.8. Quality of the tender process

The quality of the tender process is a KPI related to the procurement capabilities of the Asset Manager, which is reflected in the clarity and comprehensiveness of the requests of proposals, as well as in the number of potential suppliers invited to the organisation of the data-room/Q&A process with the potential buyers.

11.9. O&M contractor compliance

The extent to which O&M Contractors managed by the Asset Manager comply with their contractual obligations is also a KPI that measures AM service quality.