Asset Management Best Practice Guidelines (Version 2.0)

Do you prefer the guidelines as a pdf file?

Download PDFAre you interested in downloading a specific chapter?

Search the reports?

SearchIntroduction

1.1. Rationale, aim and scope

A professional and dedicated Asset Management (AM) service package ensures that photovoltaic (PV) plants, individually and as part of a wider portfolio, achieve their maximum potential from both technical and financial perspectives.

Owners, investors and lenders in the solar PV industry have increasingly acknowledged that AM services are not limited to basic day-to-day administrative tasks. I Instead, the role of a competent and multidisciplinary AM service provider is crucial to minimising operational and interface risk whilst maximising the return on investment of solar PV assets.

Asset managers can be involved in all phases of the solar power plant’s lifecycle from development to decommissioning, however these Guidelines focus on AM during operation – the longest phase of the project lifecycle. (For more information on lifecycle project management, see Chapter 3.)

- Development (typically 1-3 years)

- Construction (a few months, size-dependent)

- Operation (typically 30+ years)

- Decommissioning and disposal (a few months)

The in-depth knowledge of the assets developed during the operational phase of the PV lifecycle puts Asset Managers in a key position to influence the performance of the sites and their longevity. Asset Managers also provide vital feedback to the stakeholders involved in development and construction with the aim of optimising further the ROI of solar investments from the earliest stages of the lifecycle.

Although the solar PV industry is still developing, it already presents a wide range of well-established practices and approaches for Asset Management. This facilitates the creation of innovation niches for example in the field of digitalisation, however it also generates the lack of clarity as to what is a widely acceptable level of AM service fulfilling the main requirements of stakeholders, specifically owners, investors, lenders and other funding authorities, as well as local communities.

While a variety of international technical standards have been developed, the current level of standardization in AM remains insufficient. The typical AM scope of work varies significantly, and so does the use of advanced digital tools, both of which aspects are important factors in determining the efficiency and effectiveness of AM services.

The aim of these Guidelines is to identify the requirements for high quality AM services and promote best industry practices. The importance of Asset Management grows steadily, as the industry finds itself at an inflection point with subsidies continuously being reduced and subsidy-free PV assets requiring even tighter management to ensure that owners and investors meet their objectives.

In line with SolarPower Europe’s Operation & Maintenance (O&M) Best Practice Guidelines, the value proposition of this report is its industry-led nature, gathering the knowledge and experience of well-established and leading companies in the field of project development and construction (EPC), Asset Management, O&M, utilities, manufacturers and monitoring tool providers. The scope of the current first edition includes the utility scale segment and more specifically, systems above 1MW. The Guidelines are based on the experience of companies operating globally (with a concentration in Europe), and identify high-level requirements that can be applied worldwide for the most performant AM services. Specific national considerations such as legal requirements are not included and should therefore be considered separately if the Guidelines are to be used in specific countries. The Guidelines refer to AM services as provided by a third-party service contractor - differences in approach between third-party and in-house AM are highlighted where materially relevant.

The content covers technical and non-technical requirements, classifying them when possible into the following:

- Minimum requirements, below which the AM service is considered as poor or insufficient, and which form a minimum quality threshold for a professional and bankable service provider;

- Best practices, which are methods considered state of-the-art, producing optimal results by balancing the technical as well as the financial side;

- Recommendations, which can add to the quality of the service, but whose implementation depends on the considerations of the asset owner, such as the available budget.

As for the terminology used in this document to differentiate between these three categories, verbs such as “should” indicate minimum requirements, unless specified explicitly otherwise, as in, “should, as a best practice”.

1.2. What is Asset Management?

1.2.1. Overview

Over the past 30 years, Asset Management (AM) has evolved to become a standalone discipline. The PAS 55 (“Specification for the optimised management of physical assets”), published in 2004 by the British Standards Institution, was the first attempt at clarifying and standardising the meaning of physical AM systems. Industries such as mining, manufacturing, utilities and transport widely adopted PAS 55 and as a result the standard was accepted as a platform to develop the ISO 55000 series of international standards on “Asset Management” that was published in January 2014 and supersedes the PAS 55 documents.

The Global Forum on Maintenance and Asset Management (GFMAM), consisting of a number of maintenance and AM organisations around the globe, was established in 2010 with the objective of aligning the Asset Management Body of Knowledge (AMBOK) through a collaborative process. The GFMAM published the first Asset Management Landscape document in November 2011, which is an attempt to build a common perspective or collective view on the discipline of AM (GFMAM 2011; IAM 2015b; Saunders, C. 2016).

AM concepts have developed over time and stem from the financial services industry that has been using the term for decades to describe the management of risk and reward within financial portfolios.

Many definitions of AM exist within literature and in practice and ISO 55000 intentionally provides a very general definition to allow the Asset Manager to apply the principles to whatever form the asset takes and determine how to derive value (IAM, 2014a). ISO 55000 defines AM as:

“the coordinated activity of an organisation to realise value from assets”

The definition provided by ISO 55000 is then qualified by the following notes:

- Realisation of value will normally involve a balancing of costs, risks, opportunities and performance benefits.

- Activity can also refer to the application of the elements of the Asset Management system.

- The term “activity” has a broad meaning and can include, for example, the approach, the planning, the plans and their implementation.

Considering the sections above, this document is a first attempt aiming at defining AM best practices in the scope of the solar industry.

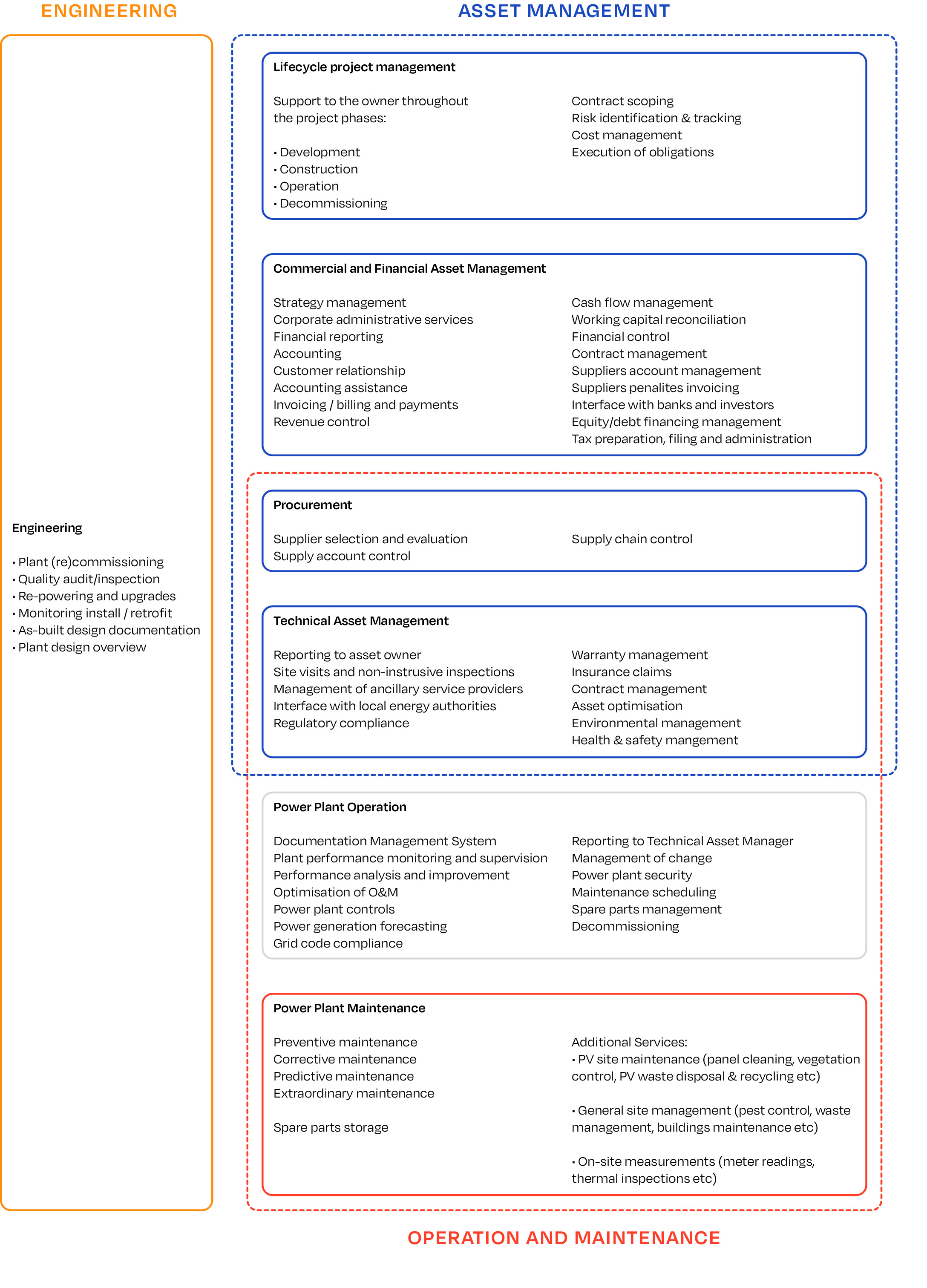

Asset Managers provide a variety of services relying on multiple disciplines and skills to asset owners, investors and funders. Services provided range from technical management and site optimisation to contract and financial management. The nature of the services is multidisciplinary, as shown in Figure 1 and the best performance results are achieved through a wide and comprehensive range of services.

While the depth of services rendered to owners and investors varies depending on the risk attitude of the stakeholders, good quality service providers should be able to undertake responsibilities covering the business areas summarised in Figure 2. The scope illustrated in Figure 2 is in line with the structure of this document (and the structure of the O&M Best Practice Guidelines) and reflects the experience of the solar industry specifically.

The interaction with O&M service providers forms a critical part of the services rendered by Asset Managers. There is a component of oversight and control of the O&M providers performed by the Asset Manager on behalf of owners to ensure that the contractual obligations are successfully fulfilled by both parties, as well as that the PV plant is properly maintained in order to increase its performance. There are however a series of potential overlaps between the two service providers particularly in relation to Technical Asset Management and performance analysis.

These overlaps may create duplications of workload and analysis conducted by the two service providers, which is a situation that owners who perform AM in-house might be able to avoid and exploit. This generally occurs when performance analysis is carried out not only in terms of basic key performance indicators (KPIs) calculations1, but also in terms of root cause analysis and subsequent warranty and/or insurance claim management. Well-established O&M contractors with significant market scale tend to extend their services to cover these Technical Asset Management tasks. How these tasks are contractually allocated to the service providers is ultimately a function of an owner’s operational risk policy, as well as corporate governance requirements. However, an AM provider should be able to perform a complete assessment of the technical health of a site, not only for reporting purposes, but also to comply with its general oversight responsibilities.

1 - For detailed information on PV power plant KPIs and O&M Contractor KPIs, see chapter 10. Key Performance Indicators of the O&M Best Practice Guidelines.

1.2.2. Asset Management key targets

AM services should consider each solar power plant or Special Purpose Vehicle (SPV) as a stand-alone business, aimed at improving profitability by increasing revenues and reducing the levelised cost of solar electricity (LCOE).

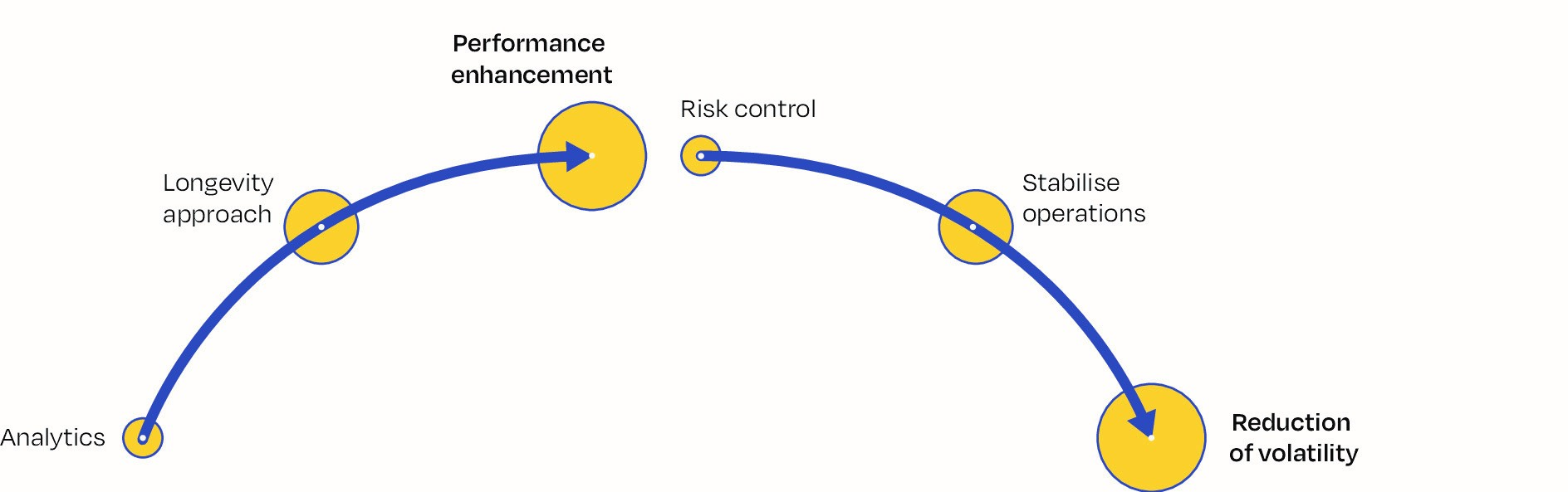

At the strategic and risk management levels, an AM service provider should offer the site owner a clear plan to increase performance and reduce volatility, as shown in Figure 3. Solid data analytics is the basis of any performance enhancement effort. The result is not only increased production from the site, but also financial performance, which means improved cost control and reduced operating costs by holding tenders and leveraging economies of scale at portfolio level where possible.

At the tactical level, risk management is carried out within the boundaries of the contract and obligations undertaken by each SPV, whilst the diligence of an AM service provider is critical to ensure that risks are kept up to date and are used to stabilise operation. Risk control is central to the operations of an Asset Management provider, as it is the basis for mitigation and contingency plans to be deployed on behalf of the owners.

A proactive Asset Manager will provide regular advice to the owner from both a technical and contractual perspective. This is one of the main aspects in which Asset Managers generate value jointly with the project developers and construction managers. Asset Managers can share their wealth of operational knowledge and hard data/statistics so that new projects can benefit from the lessons learned during the operational phase of existing sites. This support can range from considerations on contractual terms and operating cost assumptions to technical reports, effectively helping asset owners to validate their business cases.

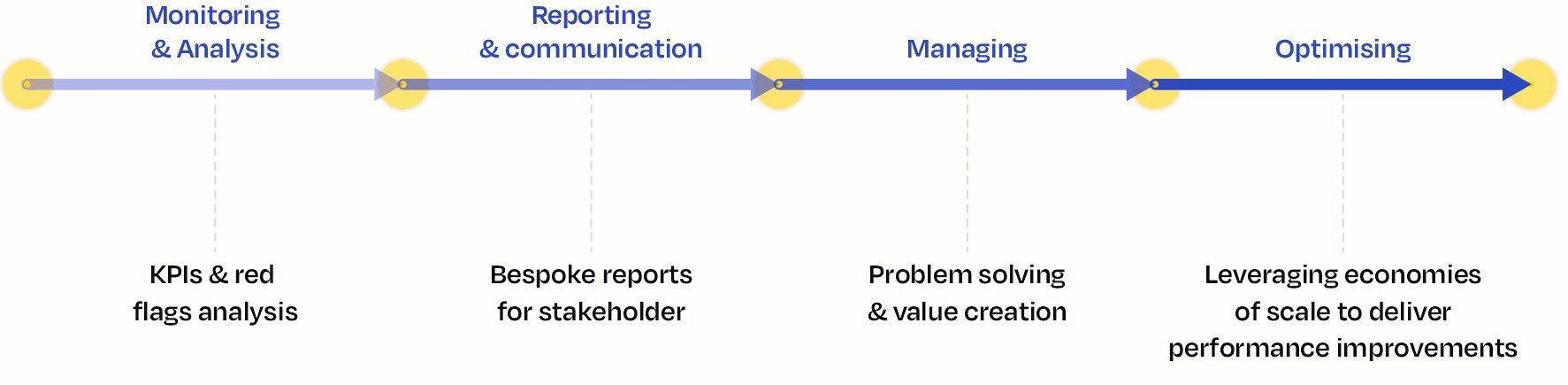

From an operational perspective, there are four pillars which should guide the work of an AM service provider in order to achieve the ultimate goal of increased profitability. These are presented in Figure 4. They apply to both technical and financial services equally, ensuring that sites are managed in a fully rounded manner.

- Monitoring and Analysis: focus on KPIs, inspection data and ‘red flag’ analysis, facilitating the identification of any specific site or portfolio-wide issues from a technical, commercial and contractual point of view;

- Reporting and Communication: as service providers, Asset Managers must produce tailored and timely reports to ensure that key stakeholders are informed and in control of their assets. Consistency and frequency in communication should be minimum standards set up by each AM service provider. Whilst it is widely accepted in the industry that Asset Managers provide regular monthly reports, emphasis must be given to ad hoc communications in case of emergencies, specific failures or claims;

- Managing: focus on problem solving of both technical failures and commercial claims;

- Optimising: focus on both technical improvements (whether trials of performance enhancer, repowering of key equipment) and financial improvements including tendering and re-financing.

1.2.3. Asset Management commitments and policies

AM service providers should ensure that their commitment toward stakeholders is clearly documented and reflected in both their customer and internal policies. The policies should be part of the induction and staff training to ensure they are properly understood and embraced in their current form as well as future revisions. As any other corporate policy, the Asset Management Policy should be intended as a living document, to be reviewed and updated regularly with contributions from employees, customers and other key stakeholders.

Compliance with both regulatory requirements and stakeholders’ undertakings are at the heart of a successful delivery of services. Achieving this result should lead the AM service provider to set up an appropriate Asset Management System, intended as both a digitalised repository of key site information and a robust and documented set of processes and procedures to be reflected in suitably automated workflows.

This leads to a high level of standardisation and efficiency in the Asset Management services, aiming at minimising non-conformities and ultimately reducing operational risk while ensuring that stakeholder and customer requirements are met satisfactorily.

Continuous improvement programs to further increase the effectiveness of the Asset Management System should be undertaken across the organisation regularly and fed into the revision of the Asset Management Policy.

1.2.4. Value-added services

An asset manager, being the collector of all relevant technical and financial data and documentation related to solar plants and their SPVs, is uniquely positioned to support asset owners in their aim to maximise returns and mitigate risks in their PV portfolios.

As indicated in the following figure, in order to achieve this goal, an asset manager should adopt a holistic approach to performance optimisation. This means that it should be able to conduct an overall assessment of the various aspects that contribute to both generating cash flows and ensuring capital protection.

It is important also for the organisational structure to be designed in a way to facilitate the focus on value creation, for example by including Portfolio Managers (as also indicated in the Chapter 9. People & Skills) who have an integrated view of each portfolio and are able to work with specialist teams to identify synergies and implement the relevant actions.

Overview of the main value-added services

Revenue enhancement

In relation to the revenue stream, an asset manager is able to have an impact by both contributing to maximise the plant production and obtain optimal conditions on the electricity sales price.

Plant production can be maximised by applying an accurate control on the activity of the O&M contractor and conducting data-analytics deriving from the daily monitoring as well from historical data assessment. Such analysis should allow the technical asset management team to identify interventions (e.g. inverter/modules revamping, improved layout, use of anti-soiling products, optimization of timing for grass cutting and module cleaning) aimed at improving the productivity of each plant.

In relation to PPAs, a well structure procurement process (as also detailed in Chapter 8. Procurement) would allow an asset manager to ensure periodic review of the available options and run tenders in order to achieve the best economic conditions (in terms of both pricing and coverage of the unbalancing / system costs). The PPA strategy should clearly take into account the attitude towards risk of each investor as well as its knowledge of the electricity market when choosing between fixed or variable prices.

OPEX and Loan Optimisation

In order for OPEX to be optimized, the same considerations applied as described in Chapter 8. Procurement. An asset manager should constantly monitor the market in order to keep track of average costs and apply a periodic “benchmarking” approach. The value add of the asset manager also consists in aggregating several portfolios and allows asset owners to benefit from a scale effect towards suppliers. It is important to note that OPEX reduction should be carefully assessed having in mind a trade-off with quality, when it comes to those services (O&M, tax advisory and even asset management itself) that can be considered as strategic and do not represent a commodity, In such case, a decision making process purely based on pricing reduction may not be the winning solution.

As asset manager should adopt a proactive approach also to loan management, by being constantly updated of the market conditions in the banking sector as well as on the changes in the portfolio of each investor in order to suggest the opportunity of a re-financing when it is more convenient. In many cases, even a “soft refinancing” (i.e. a renegotiation of the interest rates as well as the partial release of the Debt Service Reserve Account and other guarantees activated upon signature of the loan agreement) can be highly beneficial.

Tax Efficiency

An asset manager should be aware of the relevant tax benefits available to renewable investors in each country and work closely with the tax advisor to verify eligibility and implement the relevant actions, if appropriate. With green energy being currently under the favour of the legislator, tax benefits may be a relevant contribution to the cash flow generated by solar power plants in the years ahead.

Risk Mitigation

The main concern for investors that own solar power plants built under incentive schemes is to ensure the access to feed-in tariffs during the applicable time horizon. In many countries, the relevant regulatory authority (e.g. GSE in Italy, Ofgem in the UK) conduct inspections even several years after construction and providing minimum notice. As such, an asset manager should support asset owners in order for them to be comfortable about the availability and the completeness of the relevant documentation typically inspected. To this end, it is advisable to conduct pre-emptive verifications and allocate time to collect any missing documents that may not have been archived or transferred during the construction or the acquisition process.

Another relevant aspect of risk mitigation is the health & safety. An asset manager should support plant owners in ensuring the application of the relevant legal prescriptions by conducting audits on the main contractors (mainly O&M and monitoring companies), verifying that the relevant documentation is accurate and up to date and to ensure through dedicated periodic site visits that the on-site prescriptions are respected (i.e. presence of relevant signs, fire extinguishers).

In addition, a key value-added service of an asset manager consists of supporting investors during the post-construction or post-acquisition period, in order to ensure that they are effectively able to reach their base case business plan. Each item in the financial projections need to be properly monitored and it is important to strictly supervise the activity of the EPC/O&M contractors which should promptly fix any issue until the operation of the plants is stabilised. Even if a thorough due diligence is conducted, the post-construction/acquisition period can be very volatile and full of unforeseeable events and, as such, a constant on site assessment coupled with desktop analysis need to be performed by the asset manager.

Ideally, as also mentioned in Chapter 3. Lifecycle project management, an asset manager should be involved already during the construction/acquisition phase as it can bring its know-how and experience to optimise the technical features of the plants and anticipate issues that may become evident during the operational phase.

1.2.5. Stakeholders and roles

Please view chapter 3 (Stakeholders) of the Lifecycle Quality Best Practice Guidelines for a more comprehensive and up-to-date list of stakeholders.

1.3. How to benefit from this document?

This report includes the main considerations for a successful and professional AM service provision. Although it has not been tailored for each stakeholder, the purpose of the document is similar for all: understanding the mandatory requirements and the necessity of professional AM services and incorporating the recommendations accordingly into the service package for more performant AM services. Any of the directly relevant stakeholders (as described above) can benefit from this work, tailor it to their needs without lowering the bar, and know what to ask for, offer or expect. The Guidelines are particularly useful for the Asset Owners to understand what the standard of a quality Asset Management service should be. Although the focus is European, most of the content can be used in other regions around the world. The requirements described in the Guidelines apply without changes in other regions and additional requirements or modifications can easily be made for other regions with unique characteristics.

1.4. List of abbreviations

AC ... Alternating current

AHP ... Analytical Hierarchy Process

AM ... Asset Management

AMP... Annual Maintenance Plan

AMR ... Automatic meter reading

AMS ... Annual Maintenance Schedule

API ... Application Programming Interface

CAD ... Computer-aided design

CCTV ... Closed Circuit Television

CMMS... Computerised maintenance management system

COD ... Commercial operation date

CSMS ... Cybersecurity management system

DC ... Direct current

DMS ... Document management system

DOR ... Division of responsibility

DSCR ... Debt service coverage ratio

DSL ... Digital Subscriber Line

EH&S ... Environment, health and safety

EMS ... Energy Management System

EPC ... Engineering, procurement, construction

EPI ... Energy Performance Index

ERP ... Enterprise Resource Planning System

ESS ... Energy Storage System

FAC ... Final acceptance certificate

FIT ... Feed-in tariff

FTP ... File Transfer Protocol

GPRS ... General Packet Radio Service

H&S ... Health and safety

HV ... High voltage

IEC ... International Electrotechnical Commission

IGBT ... Insulated-Gate Bipolar Transistors

IPP ... Independent power producer

IR ... Infrared

IRENA ... International Renewable Energy Agency

KPI ... Key performance indicator

kW ... kilowatt

kWh ... kilowatt-hour

kWp ... kilowatt-peak

LAN ... Local area network

LCOE ... Levelised cost of electricity

LTE-M ... Long Term Evolution, category M1

LPWAN ... Long-power wide-area network

LV ... Low voltage

MAE ... Mean absolute error

MIT ... Minimum irradiance threshold

MPPT ... Maximum Power Point Tracking

MV ... Medium voltage

MW ... Megawatt

O&M ... Operation and Maintenance

OEM ... Original equipment manufacturer

OS ... Operating system

PAC ... Provisional acceptance certificate

POA ... Plane of array

PPA ... Power purchase agreement

PPE ... Personal protective equipment

PR ... Performance Ratio

PV ... Photovoltaic

RMSE ... Root mean square error

ROI ... Return on investment

RPAS ... Remotely Piloted Aircraft System (drone)

SCADA ... Supervisory Control And Data Acquisition

SLA ... Service-level agreement

SPV ... Special purpose vehicle

STC ... Standard Test Conditions (1000 W/m2, 25°C)

UPS ... Uninterruptible Power Supply