Asset Management Best Practice Guidelines (Version 2.0)

Do you prefer the guidelines as a pdf file?

Download PDFAre you interested in downloading a specific chapter?

Search the reports?

SearchProcurement

The role of the Asset Manager in the solar sector is crucial in order to identify, select and properly manage the key suppliers involved in the operation of the SPVs and the plants. (On the latter, see section7.14. Suppliers account management). In particular, the Asset Manager should leverage their know-how and network of contacts in order to both identify the right trade-off between price, quality of services and key contractual terms, and constantly adapt all of them to market conditions.

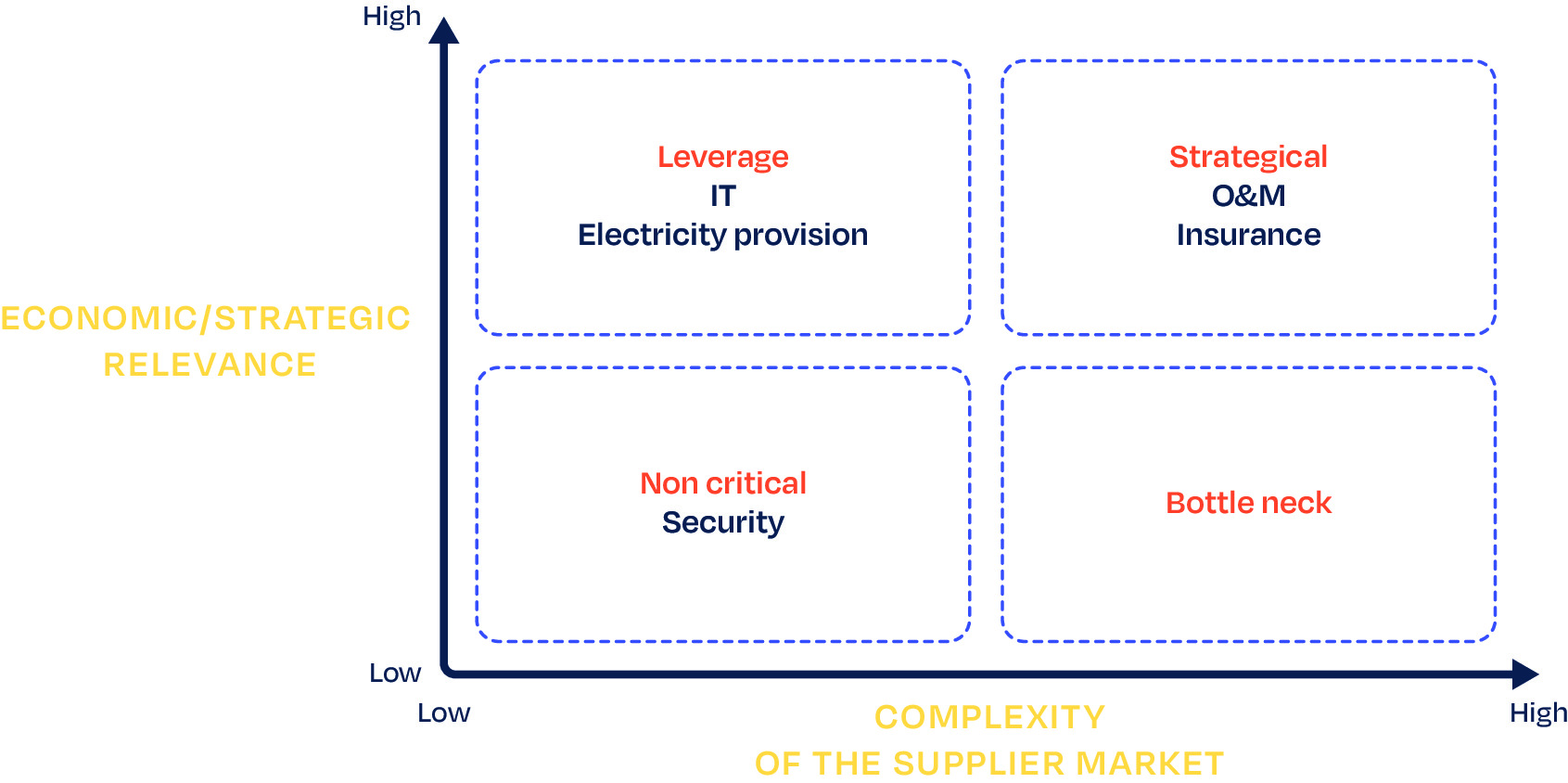

In line with the procurement best practices, before deciding the optimal procurement strategy, the suppliers should be classified based on two key criteria:

- Strategic relevance: in terms of value-added, overall costs in the supply chain and impact on profitability and quality.

- Complexity of the supplier market, in terms of number of suppliers, features of the supply (scarcity).

Taking these criteria into account, the main suppliers involved in solar power plant operation can be allocated in the following matrix:

The position in the matrix drives the optimal approach to manage a supplier. In particular, the following approaches are recommended:

- IT (connectivity), electricity suppliers represent the so called “leverage” services. The impact on the business is very high: good connectivity allows efficient and continued plant monitoring while robust insurance coverage allows CAPEX and OPEX to be reduced in case of damages and thefts. The supply market for all these services is typically abundant. As a consequence, the advisable approach consists of standardising the need, concentrating large volumes of plants wherever possible (to achieve better terms), and involving a large number of qualified suppliers.

- Security represents, in most cases, a non-critical service:1 the impact on the profitability of PV plants is limited (considering that direct and indirect damages are covered by the insurance policies) and the supply market is abundant. The recommended approach in this case consists of co-sourcing and standardisation of needs and volume bundling (possibly involving surveillance companies with a national presence in order to have the same counterparty in various regions, as also detailed in the following section).

- O&M contractors represent a strategic supplier. The quality and effectiveness of the O&M activity have a relevant impact on the revenues as well as on maintenance costs related to the plants. Although the supply is characterised by a large number of operators, the recent trend in mature solar markets consists of an aggregation of operators (hence reducing the number of potential candidates). In addition, the number of O&M contractors with robust and local structures is very limited. This results in the selection process being particularly complex. It is advisable in this case to apply a collaborative approach and supply base redesign (information sharing, long-term agreements, supplier audit focused on managerial skills) and a value-based (rather than price-based) approach.

- Insurance companies have strategic relevance in the operation of PV plants, as with a solid all-risks policy in place, plant owners receive a relevant mitigation of risks in relation to both direct and indirect damages in case of thefts, fires, equipment failures and cybersecurity attacks. The procurement of insurance policies for renewable energy plants in the last few years has become increasingly complex due to a lower number of suppliers available. This is because several insurance companies left the market due to an actual level of risk being higher than initially expected. The presence of professional Asset Managers and more robust security equipment/clearer component warranties should give comfort to the suppliers in the future and result in more accessible procurement.

1 This is not true for ground-mounted plants (particularly affected by thefts) in some particular geographical areas. In such cases, this service becomes “leverage” and requires the same approach described above for IT and insurance coverage.

8.1. Main supplier requirements

- IT (connectivity): Should provide coverage that is as broad as possible and, in particular, also reach remote areas where PV plants are typically located.

- Insurance: Should cover key operational risks (including cybersecurity for the reasons explained in Chapter 10. Data management and high-level monitoring). The role of the Asset Manager in the procurement process is key in order to ensure that the security equipment installed on each site is aligned with the requirements set out in the policies, as such requirements typically represent condition precedent and any inconsistency would result in the coverage being ineffective

- Security: Should provide a professional service with an effective alarm management process and being able to prove the implementation of the agreed services (e.g. with punching).

- O&M services: Should have a strong technical know-how, a robust organisation structure to manage local interventions and spare parts, and to be able to fix plant unavailability as quickly as possible.

- Ancillary services (electricity provision): Should provide high-quality customer services to support in administrative matters (i.e. bill payments).

8.2. Supplier selection and evaluation

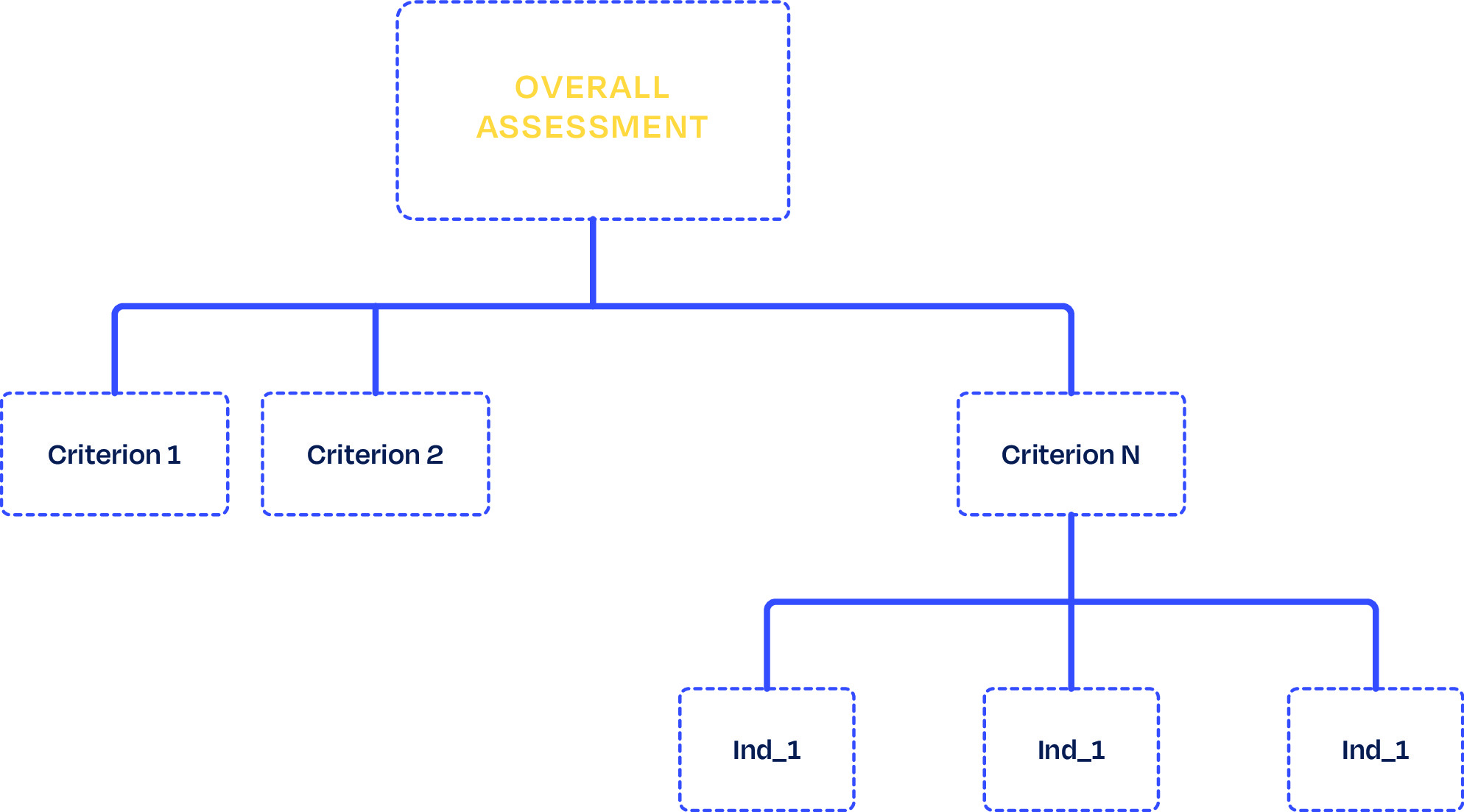

The recommended methodology for an Asset Manager to select a supplier is the Analytical Hierarchy Process (AHP). As illustrated in the following figure, the AHP considers a set of potential suppliers. Each supplier receives a “rating” based on a set of evaluation criteria which are assessed based on specific indicators. It is important to note that since some of the criteria could be contrasting, it is generally untrue that the best option is the supplier that optimises each single criterion, but rather the one that achieves the most suitable trade-off among the different criteria.

The AHP is very lean and in the selection process it allows not only quantitative but also qualitative elements to be taken into account. It also enables a different weight to be attributed to the different indicators and selection criteria, and hence, to attribute rational importance to the various aspects of the decision-making process.

| SUPPLIER | CRITERIA | SOURCE OF INFORMATION |

| O&M [4] | - Organisation structure; - Track record; Pricing, taking into account the scope of work and service level; - Financial soundness; - Bankability | - Visit to control room; - Q&A; - Certifications; - References; - Internal data collected by the Asset Manager |

| Insurance policies | - Financial soundness of the insurance company; - Effectiveness of the claim management process | - Rating report; - Track record provided by the insurance companies / the brokers; - References provided by other clients |

| IT | - Reliability; - Geographical reach | - Track record |

| Security | - Reliability; - Local presence (with direct personnel); - Effective management process; - Relevant certifications in place | - Track record (including references from other clients); - Visit to control rooms |

| Electricity provision | - Reliability; - Customer service | - Track record |

TABLE 14 - KEY CRITERIA FOR THE SELECTION OF THE VARIOUS SUPPLIERS

4 - To evaluate O&M contractors, it is recommended to use SolarPower Europe’s O&M Best Practices Checklist which is based on the O&M Best Practices Guidelines and can be downloaded from www.solarbestpractices.com.

8.3. Further considerations to be taken into account in the selection process

Consideration related to portfolios under management and scale effects

The Asset Manager can add value in the procurement process, not only by leveraging its proprietary know-how (based in particular on its direct observations and historical evidence of the activity of the various suppliers) and network of contacts, but also by allowing its clients to benefit from a scale effect, aggregating, for the purpose of running a tender process, the various portfolios, similar in terms of features, geographic location and client requirements.

Sourcing strategy

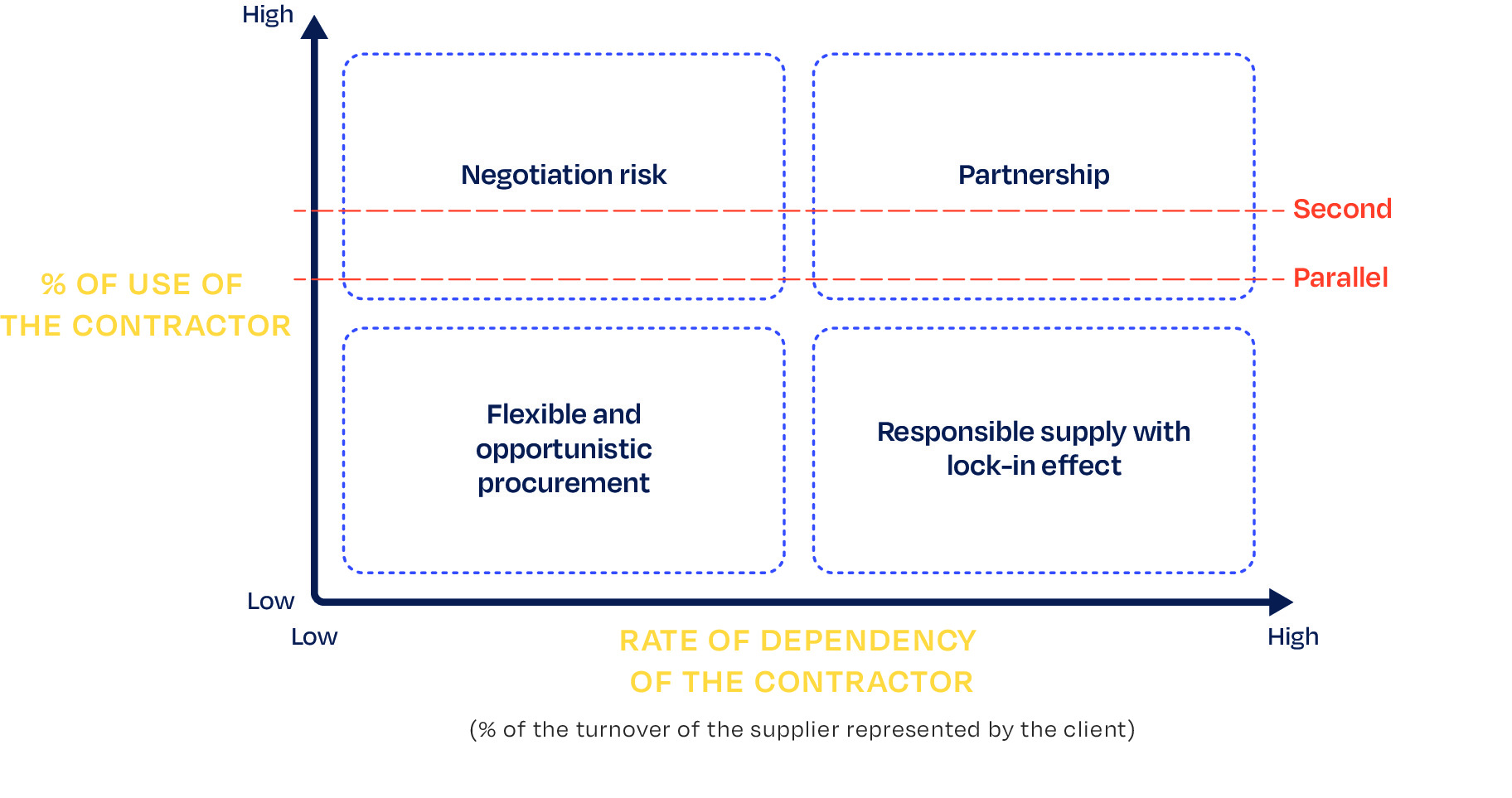

As the O&M activity represents a strategic service, if the solar portfolio has sufficient scale, it is advisable to avoid a single sourcing (i.e. allocating 100% of the activity to the same contractor). Instead, either a second sourcing (by identifying a main contractor which would manage the majority of the plants and a second contractor with a more limited exposure) or parallel sourcing (with two or three contractors which manage similar percentages of the portfolios) is recommended. Both these strategies (to be applied based on the features of the portfolios and of the O&M contractor market) have the advantage of a collaborative approach between O&M contractors involved while at the same time leaving the possibility of benchmarking, better peak management and a pre-identified backup operator leading to a smooth switch in case it is needed.

In addition, in the sourcing strategy of the O&M contractor, an Asset Manager/Asset Owner should consider the relevance of its contracts in relation to the activity of each selected contractor. In particular, for large portfolios assigned to relatively smaller operators, since it is very likely that there is a situation of high dependency (i.e. high percentage of the contractors turnover represented by the plant owner), it is advisable to apply either a partnership approach or “responsible supplier management” by making a long-term commitment in order to allow the contractor to organise their resources and make the relevant investments to reach a high-quality delivery.

The role of financing institutions in the selection process

In case of portfolios with bank financing in place, the process to select the strategic contractors (mainly O&M, insurance companies and PPA counterparties and negotiate the mandate with them) should take the prescriptions of the loan agreement into account, which in some cases may contain a template of the agreement to be entered into. In addition, the selected supplier should be approved by the financing institution following a qualification process.

Health & safety considerations

An Asset Manager should also ensure that the O&M contractors and the surveillance companies respect the right H&S requirements by conducting a so called “technical professional verification”, i.e. by verifying the compliance with training programs and medical requirements, as well as by reviewing the existing risk rating document.

8.4. Supply account control

The role of the Asset Manager is crucial in order to ensure that each supplier delivers a high-quality service according to market best practice and contractual obligations. In order to monitor the supply account, the Asset Manager should identify some indicators, periodically monitor them, and take appropriate and timely actions in case of situations not aligned with expectations. The most common KPIs are summarised in the table below.

| SUPPLIER | KPI | FREQUENCY OF VERIFICATIONS |

| O&M | - Track record of contractual KPI guarantees (Availability, Response times) [5] | Monthly |

| Insurance policies | - Respect of the requirements during the life of the contract - Monitor through the broker the financial soundness of the counterparty - Ensure a smooth and quick process to manage claims | Continuous |

| IT | - Days of availability of the services | Continuous |

| Security | - Number of thefts that occurred in the plants - Reaction time in case of thefts - Evidence of the activities (e.g. patrols) conducted | Monthly/in case of events |

| Electricity provision | - Response time of the customer service in case of issues | In case of events |

TABLE 15 - KEY PERFORMANCE INDICATORS FOR RELEVANT SUPPLIERS

5 - For details, see chapters 10. Key Performance Indicators and 11. Contractual Framework of the O&M Best Practice Guidelines.

8.5. Supply chain control

It is important for each provider to identify and mitigate the risks related to the supply chain, i.e. to avoid the risk of poor service or lack of delivery which may have negative effects on the overall risk-adjusted returns of renewable energy assets.

To this end, the Asset Manager should keep strict control not only on the supply side (through a combination of appropriate controls during the selection phase and ongoing monitoring, and pre-identify back-up plans) but also on the demand side by ensuring smooth interaction and timely communication with the suppliers.

Another important factor to take into consideration is the possible verification of extraordinary events (as recently demonstrated by the impact of the coronavirus pandemic) that may affect the delivery capability of key suppliers. In order to ensure business continuity, it is important to adapt a combination of risk mitigation practices: avoid concentration risk (and have a “backup” suppliers, even with a lower allocation of activities but ready to step in), outsource to organization with a local presence and to ensure that the suppliers have a safe data storage with backup systems accessible remotely.

Supply side

The following table presents the main supply side risks and suggested mitigation measures.

| SUPPLY CHAIN RISK | RELEVANT SUPPLIER | MITIGATION MEASURES |

| Poor quality of services | O&M, surveillance | Ensure the proper KPI as described above and take immediate actions in case of alarming indicators Avoid single supplier in case of portfolios with critical mass |

| Unavailability of services due to technical issues or extraordinary events | Ancillary services, IT, O&M, surveillance | Constant supervision and immediate alert of the Asset Manager Pre-identified alternative suppliers to involve in case of persistent issues |

| Inflexibility of supply source | O&M, surveillance | Parallel, Second sourcing |

| Subcontractor risks | O&M, surveillance | Verification of the contractor supply chain during the selection process |

| Bankruptcy of the suppliers/suppliers exiting the relevant market | All suppliers | Multiple providers (if allowed by critical mass), although this requires a higher management effort – all providers Request of insurances (e.g. bonds for PPA) |

| Lack of relevant renewal of legal and H&S certifications | O&M, surveillance | Constant supervision by the Asset Manager Parallel/second sourcing to allow a smooth and rapid switch in case of persistent non-compliance |

TABLE 16 - SUPPLY CHAIN RISKS AND MITIGATION MEASURES

Demand side

As mentioned above, the Asset Manager should also both directly and by providing guidance to its clients, help the suppliers in properly executing their activities. The supply chain can be positively affected by proactive actions on the demand side in the following circumstances:

- Accurate planning: In case of predictable peaks (e.g. in case of a planned relevant revamping interventions or with relevant upcoming plant acquisitions) it is crucial for the Asset Manager to inform the relevant suppliers involved in order to allow them to properly arrange the delivery and avoid resource bottlenecks and be able to serve the client needs in due course.

- Accurate information shared with the suppliers: Both during the handover phase to a new supplier and the ongoing activity, there should be a constant and constructive sharing of information in order for the Asset Manager to be aware of critical aspects and proactively solve them.