Asset Management Best Practice Guidelines (Version 2.0)

Do you prefer the guidelines as a pdf file?

Download PDFAre you interested in downloading a specific chapter?

Search the reports?

SearchRisk management in the operational phase

This chapter focuses on the risks emerging from the commercial operation date (COD). Risks associated with the inception phase are discussed in the current version of SolarPower Europe’s EPC Best Practice Guidelines. In this context, particular attention might therefore be given when it comes to the handover of assets as discussed in Chapter 5. At that point, understanding the risk exposures from an EPC perspective is indispensable.

Furthermore, the risks discussed in this chapter can hardly be directly attributed to individual chapters, and therefore, it is highly recommended to appreciate the content in the following chapters and to relate them to the risks in this chapter as appropriate for the individual situation.

Whilst solar asset owners establish their specific risk framework, governance and guidelines based on their unique risk appetite and investment criteria, Asset Managers play a crucial in managing such risks and deploy or recommend mitigants to the owners. Based on the risk management governance established by the Owner, the Asset Managers might be called to review risks and deploy lesson learnt at different pace; an annual risk review of the key risks highlighted below is recommended as minimum standard to establish between Owner and service provider.

4.1. Definition of risk and risk management

Risk is generally defined as exposure to the possibility and the probability of damage, injury, liability, loss, or any other negative occurrence that is caused by external or internal vulnerabilities, and that may be avoided through preemptive or other action. In an attempt to standardise the terms risk and risk management, the authors refer also to ISO guide 73 and to ISO 31000:2018. ISO guide 73 defines risk more simply as “effect of uncertainty on objectives”:

| Effect | Positive and negative deviations from the expected |

| Uncertainty | State – even partial – of deficiency of information related to, understanding or knowledge of, an event, its consequence, or likelihood |

| Objective | - Different aspects: financial, health and safety, environmental etc. - Different levels: strategic, organization, project, product, and process |

TABLE 2 - DEFINITION OF RISK

ISO 31000:2018 provides generic guidelines for the design, implementation and maintenance of risk management processes throughout an organisation, see the following figure.

To effectively manage risks, it is mandatory to analyse the risk exposure. This involves the identification of the risks at play, the measurement, most importantly by assessing the impact and the likelihood in the case of occurrence, and to evaluate the risks as a result.

Managing risk on the other hand, involves a closed loop process: As a first consideration, risks can be systematically avoided or at least reduced by mode and setting of operational parameters. Unavoidable risks can be mitigated by controlling the risk and continuous process improvements, e. g. involving a failure mode and effect analysis. Risks can be transferred by various measures, e. g. contractually by shifting the responsibility of certain processes to another party, by buying cover through an appropriate insurance, or by simply setting up a purpose specific limited liability company (so called “SPV”), to name a few. Finally, it is highly recommended to accept and to monitor and report residual risk to ensure that risk exposures remain within manageable limits.

4.2. Financial risk factors

Asset management actually starts from the very beginning of the project. The SolarPower Europe EPC Best Practice Guidelines deal with risk management until commercial operation date (COD) while this chapter deals with risks starting with COD. A selected number of financial risk factors are explained in the following table:

| Exchange rate | Exposure to different currencies might affect the financial performance of a solar PV plant primarily when purchasing spare parts or when the investment currency is different from the currency of the cash flow return on investment. |

| Power price fluctuation (merchant plant) | Since the market for solar PV generation has started to move towards so called merchant business models meaning that the power purchase price may be fixed based on fluctuating market conditions, the quality of financial returns are naturally influenced by such fluctuations. It is recommended to thoroughly analyze and weigh upsides and downsides carefully. |

| Refinancing | Refinancing risks are generally triggered by 2 factors, the inability to restructure the debts because of malperformance of the PV power plant or by the simple difference of refinancing conditions – including leverage rate and interest rates – at the time the refinancing becomes necessary. |

| Trading risks (cannibalization, negative pricing) | With the increased dispatch of renewable generation (and solar in particular) and fluctuation of demand for given time span, the risk of over generation and negative pricing is becoming a more likely risk that solar generators have to account for. Whilst cannibalization is not easy to predict and depends on each country energy mix, electricity use pattern, and electricity market regulations, it is critical for assets owners and AM service providers to consider mitigation measures such as e. g. enabling demand based power dispatch by securing storage capacities. |

| Solvency of off-taker | (see section 4.6. Commercial risks) |

TABLE 3 - FINANCIAL RISK FACTORS

4.3. Regulatory and policy risk factors

This section provides a short overview of regulatory and policy risks. Regulatory risks are related to e. g. adjustments in government schemes that can possibly be imposed at any time during the lifetime of a PV power plant project, sometimes even retroactively. Such risks typically materialize when a scheme is overstretched vs. the original intent or vs. the government budget capacity or when the political intentions of energy policy change generally. The following table shows some examples:

| Regulatory changes (e. g. grid code change, (retroactive) change in off-take price) | Over the course of the past 10 years, the solar industry in Europe has faced number of significant changes in law that have affected not only development but also operation of solar PV sites. From changes (whether retroactive or otherwise) to the subsidy schemes to new requirements embedded in grid codes and distributions networks operations, solar PV plants have faced potential reduction of revenues (reduction of subsidies, increase in grid constrains) as well as the potential for increased operating costs to allow operation within new grid connection parameters or to comply with new tax regime imposed from time to time. |

| Political risks | Overall, renewables have enjoyed a general political support. Whilst has supported the growth of the industry with the introduction of subsidy schemes, it has also increased the dependency of the industry toward political decisions. These can range from local government change of attitude toward renewables as well as central governments needs to limit the costs associated to subsidies schemes. |

| Government imposed compliance assessment risks | Almost in every jurisdiction in which renewables have been sustained by subsidy schemes, governments and regulators have maintained a right to inspect and audit renewable plants to ensure that subsidy eligibility criteria are met. For a reasonably young industry, like solar, with limited benchmarking and track record, it has proven more challenging to ensure that all documentation is readily available for inspection. |

TABLE 4 - REGULATORY RISK FACTORS

4.4. Contractual risk factors

Contractual risk is defined as the probability of a loss arising from either one of the following two situations:

- The chance of facing losses as a result of the buyer not fulfilling the terms of a contract; note that if the buyer is incapable of paying this is another risk category.

- The chance of facing losses from the deal performing poorly. Sellers face the most danger in fixed-price contracts and the least in cost-type contracts.

Practically, not all risks can be addressed and assigned in contracts. To tone down contractual risks several steps can be taken to manage contractual risks, for example:

- Discuss with people from various departments of your organization to determine risks.

- Evaluate and estimate the likelihood and severity of the risk involved in the contract.

- Consider if any high-risk work is worth taking on. If not, reject the project as necessary.

- Evaluate your business partners re financial stability and actual business conduct.

- Etc.

These steps should function like clockwork within the organization. Otherwise, one may find oneself inundated with unforeseen issues. By that point, it will be far too late to apply measures to offset the damages.

4.5. Technical risk factors

Even if PV technology is in general rather simple, there are several risks due to the rapid evolution in this sector and the exposure of PV plants to environmental risks, see the following table:

| Major module serial problem | Rapid evolution of photovoltaics means that module technology changes continuously and radical changes are common. Combined with the high dynamics of the PV market, this gives room for chances, but also for risk. This may not be neglected, because the PV module is one of the central elements of a PV system, and it is the most expensive to replace. Therefore, an asset should consist of solidly performing and low-cost maintenance components. Systems such as IECRE can support the evaluation. |

| Disposal/ Recycling | Disposal of plant components at end of operations represents a cost risk. This is especially true for PV modules and inverters, whereas disposal of most balance of system (BoS) components may be less challenging, because value of raw material tends to rise (support structure, cables) and the amount of other electronic waste is negligible. |

| Technical performance risks | During operations technical performance of the PV plant needs to be monitored in order to detect any faults, including serial faults, increased module degradation etc., inverter performance etc. |

| Operational risks | The PV power plant may experience important underperformance if the O&M contractor does not fulfill his contractual obligations. The problem is that this may not manifest itself at once as losses in production, and an asset manager may become aware of any deviations only at a later point in time. Therefore, asset managers should always stay in communication with O&M contractor and eventually inspect sites spontaneously or at times even unannounced. |

| Environmental risks | Among the environmental risks climatic change is a general topic. This may lead to higher irradiation, but also to higher wind speeds and a higher frequency of more impacting meteorological phenomena like violent thunderstorms, tornados, hail etc. Long periods of drought may increase risk of fire and reduce permeability of soil. Events of strong rain, eventually combined with an insufficient quality of the drainage system, may result in a high risk of flooding, increased erosion, or even more violent events like landslides. This risk may be even more important, if slope of terrain is high. Site-specific risks include also the risk of inherited pollution. In fact, developers are often encouraged to plan PV plants on industrial wasteland, in order to reduce the use of valuable agricultural land. Since the plant owner needs a real property right on the building site, he becomes also responsible for the site and the pollution on it. Hazards due to pollution, for example for ground water, may oblige him to rehabilitate the site, and this may result in high additional costs, which have not been considered in the business plan. |

TABLE 5 - TECHNICAL RISK FACTORS

A lot of these technical risks result from improper practices during the inception phase of the project, therefore, it is recommended to refer to SolarPower Europe’s EPC Best Practice Guidelines (2020).

4.6. Commercial risk factors

Commercial risks (contract interface risks) arise predominantly when individual contracts between adjacent stakeholders are not defined “back-to-back” meaning that the interfaces are seamlessly defined in the chain of contracts. Naturally, identifying any gaps and the resulting risks for an asset manager are essential. To illustrate the risks more practically, the following table outlines exemplary commercial risks:

| Risk of concentration | Especially in the situation whereby the electricity produced by a PV power plant is sold on the merchant market (e. g. day-ahead market), an inherent selling price risk becomes evident as the concentration of power generation plant increases in a given geographic neighborhood. Proper price forecasting methodologies, hedging, futures and other financial mitigation measures can help mitigate this risk as well as securing power storage capacity. |

| Procurement risks | Once the commercial operation date, and more so when the FAC or the commissioning date has elapsed, procurement of spare parts or simply of services may turn out to pose significant risks, e. g. given by availability or costs of spare parts. Even with escalation formulas that are typically based on statistical indices, there is a remaining risk by way of such indices not reflecting the actual situation for the specific components or services to be purchased. |

| Change parties (e.g. O&M contractor) | Changing parties during the lifetime occurs under various circumstances: - Change in ownership of the PV power plant; - Change in controlling party of one of the contractual partners in the chain; - Change of the O&M service provider; - Change of the asset manager; - Insolvency of a contractual party; - Dissolution / disappearance of a contractual party etc. |

| Grid works | Occasionally, major maintenance work on the power lines within the power grid may occur, and as a consequence, in the event that there would be only one power connection point, the power sales collapses completely for this period of time resulting in significant loss of revenue. There are several risk prevention or mitigation measures, e. g. building 2 or more power access points that feed into different parts of the grid system, covering the risk by insurance, agreeing with the grid operator to be compensated for loss in revenue, or at least agreeing with the off-taker that such an event would be considered force majeure. |

| Theft | Even though the price of PV power plants has come down significantly over the last 20 years, theft of PV power plants is a severe issue in several geographies. Such risk is typically transferred. |

TABLE 6 - COMMERCIAL RISKS

4.7. Risk transfer

Risk transfer refers to a risk management technique in which risk is transferred to a third party. In other words, risk transfer involves a party assuming the liabilities of another party. There are two common practices to transfer risks:

| Insurance policy | As outlined above, purchasing insurance is a common method of transferring risk. When an individual or entity is purchasing insurance, they are shifting financial risks to the insurance company. Insurance companies typically charge a fee – an insurance premium – for accepting such risks. Purchasing insurance is a common example of transferring risk from an individual or entity to an insurance company. |

| Indemnification clause in contracts | Contracts can also be used to help an individual or entity transfer risk. Contracts can include an indemnification clause – a clause that ensures potential losses will be compensated by the opposing party. In simplest terms, an indemnification clause is a clause in which the parties involved in the contract commit to compensating each other for any harm, liability, or loss arising out of the contract. |

TABLE 7 - RISK TRANFER

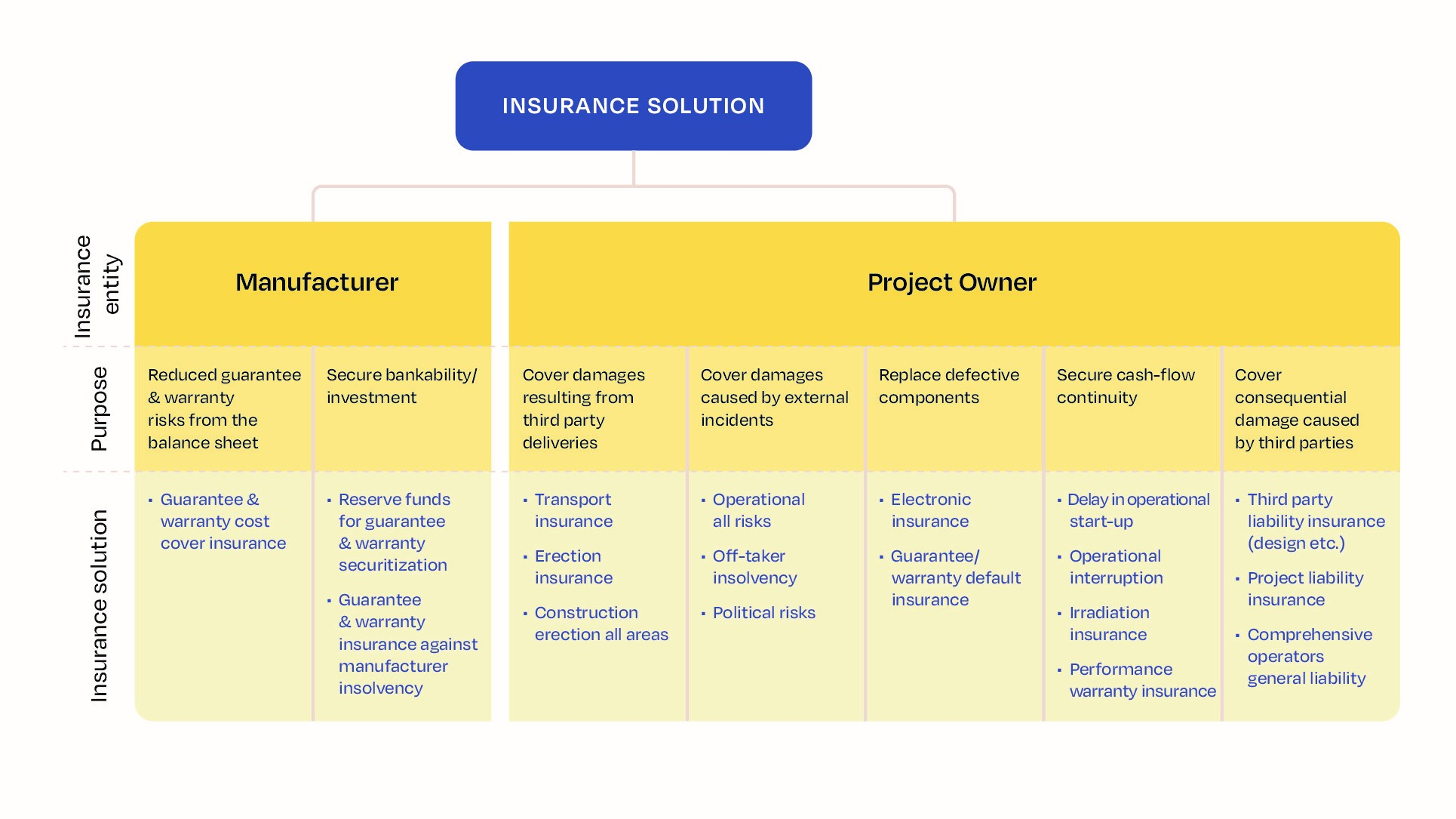

The following figure provides an overview of insurance solutions commonly requested in the photovoltaic industry, based on an detailed insurance study and market analysis (EXXERGY, 2018).

4.8. Sector reputational risks

As the share of solar power generation is moving towards 10%, 20% and more, the visibility of the PV market will continue to increase to the point where the performance of solar power plants will eventually become system critical. To avoid a loss of sector reputation, it is highly recommended that relevant stakeholders apply proper risk management strategies, including quality assurance procedures and conformity assessments regularly throughout the lifetime of a PV power plant. Initiatives that support this objective include PVQAT as well as an international system under IEC defining international standards for conformity assessment, IECRE. A suite of internationally accepted operational documents for conformity assessment has been issued by IECRE already, and more are expected to be developed in the near future, including a rating system for PV power plants.