Asset Management Best Practice Guidelines (Version 2.0)

Do you prefer the guidelines as a pdf file?

Download PDFAre you interested in downloading a specific chapter?

Search the reports?

SearchTechnical Asset Management

Technical Asset Management (TAM) encompasses support activities to ensure the best operation of a solar power plant or a portfolio, i.e. to maximise energy production, minimise downtime and reduce costs. It comprises the activities presented in this chapter.

It is not easy to draw a sharp line between the high-level tasks of the operations team and the more technical responsibilities of the Asset Manager. A simple way to provide some clarity would be that Asset Managers are policing the activities of the O&M providers and reassure compliance and contractual conformity. In many cases, the O&M Contractor assumes some tasks related to Technical Asset Management such as KPI reporting. The below tasks can be regarded as Technical Asset Management and can be performed by the O&M Contractor or the Asset Manager. In line with this, this chapter is also featured in SolarPower Europe’s O&M Best Practice Guidelines. In cases where the Technical Asset Manager and the O&M Contractor are separate entities, a close coordination and information sharing between the two entities is indispensable. This involves integral knowledge about how much a project should be producing for any given time, considering factors such as weather, seasons, or degradation of assets, and ensuring long-term energy infrastructure reliability. It represents the entire value chain from investors to Asset Managers and service providers.

6.1. Technical reporting

The Technical Asset Manager is responsible for preparing and providing regular reporting to the Asset Owner and other stakeholders defined in the agreement between the Asset Owner and the Technical Asset Manager.

The frequency of the reporting can be set daily, weekly, monthly, quarterly or annually (with monthly being the most common and considered a best practice), with specifically defined content for each of these reports. Generating a report for any specific time range in the past can also be possible. Detailed time-series data should also be reported or at least archived in the reporting system in order to improve the correct availability calculations. The spatial resolution of reports should be on the level of each inverter to better detect under-performing sections of the plants managed.

The following table includes some proposed quantitative and qualitative indicators which should be in reports as a minimum requirement, a best practice or a recommendation. For more details on the individual indicators, see Chapter 10. Key Performance Indicators of SolarPower Europe’s O&M Best Practice Guidelines.

A new trend in the industry is to extend the reporting beyond the pure PV plant indicators and to incorporate reporting on the actual activities. This means that both the Asset Manager and the O&M Contractor can operate with a CMMS (Computerised Maintenance Management Systems) in order to measure various O&M KPIs (e.g. Acknowledgement Time, Intervention Time, Reaction Time, Resolution Time) and equipment performance (e.g. Mean Time Between Failures). The Technical Asset Manager should also report on Spare Parts Management and in particular on spare parts stock levels, spare parts consumption, in particular PV modules on hand, spare parts under repair. With the emergence of Predictive Maintenance, the Technical Asset Manager can also report on the state of each individual equipment. Furthermore, the periodic reporting can include information on the status of the security and surveillance system. In this case, the security service provider is responsible for providing the relevant input to the Technical Asset Manager.

| TYPE OF DATA | PROPOSED INDICATOR | TYPE OF REQUIREMENT |

| Raw data measurements | Irradiation | Minimum Requirement |

| Active Energy Produced | Minimum Requirement | |

| Active Energy Consumed | Best Practice | |

| PV Power Plant KPIs | Reference Yield | Recommendation |

| Specific Yield | Recommendation | |

| Performance Ratio | Minimum Requirement | |

| Temperature-corrected Performance Ratio | Best Practice | |

| Energy Performance Index | Best Practice | |

| Uptime | Best Practice | |

| Availability | Minimum Requirement | |

| Energy-based Availability | Recommendation | |

| O&M Contractor KPIs | Acknowledgement time | Minimum Requirement |

| Intervention time | Minimum Requirement | |

| Response time | Minimum Requirement | |

| Resolution time | Minimum Requirement | |

| Equipment KPIs | Mean Time Between Failures (MTBF) | Recommendation |

| Inverter Specific Energy Losses | Recommendation | |

| Inverter Specific Efficiency | Recommendation | |

| Module Soiling Losses | Recommendation | |

| Environmental KPIs | Environmental and Biodiversity KPIs may vary depending on the geography, the micro-climate and the conditions of each site | Best Practice |

| Incident Reporting | Main incidents and impact on production | Minimum Requirement |

| Warranty issues | Best Practice | |

| EH&S issues | Best Practice | |

| Spare parts stock levels and status | Best Practice | |

| Physical and Cyber Security Issues | Minimum Requirement | |

| Preventive Maintenance tasks performed | Best Practice |

TABLE 10 - PROPOSED INDICATORS/VALUES REQUIRED FOR THE REPORTING

On top of the periodical standard reports (monthly, quarterly or yearly) where operations activities are reported by the Technical Asset Manager to the Asset Owner, it is a best practice for the Technical Asset Manager to provide an intermediate operation report when a fault is generating a major loss. A loss due to a fault is considered major when PR and availability are affected by more than a certain threshold throughout the ongoing monitoring (or reporting) period. A best practice is to set this threshold to 1% of Availability or 1% PR within a reporting period of one month. The report should be sent as soon as the fault is acknowledged or solved and should contain all the relevant details related to the fault together with recommendations for Extraordinary Maintenance when the necessary operations are not included in the maintenance contract.

- Typically, this maintenance report should contain: Relevant activity tracks (alarm timestamp, acknowledge time, comments, intervention time, operations on site description, pictures etc)

- The estimated production losses at the moment of writing the report

- The estimated production losses for the total duration of the period, counting on the estimated resolution time if the issue is not solved yet

- The device model, type and Serial Number when the fault is affecting a device

- The peak power of the strings connected to the device(s)

- The alarm and status log as provided by the device

- The resolution planning and suggestions. Eventual replacement needed

- Spare parts available

- Estimated cost for the extra-ordinary maintenance

6.2. Site visits and non-intrusive inspections

As a best practice, the Technical Asset Managers should undertake a bi-annual site visit in coordination with the O&M provider to perform a non-intrusive visual inspection, address current maintenance issues and plan out in cooperation with the O&M contractor and the ancillary service providers (if different) a maintenance improvement plan. It is becoming a best practice for Technical Asset Managers to commission aerial inspections, such as thermography. Using independent providers of these services can be a fast and low-cost way to assess O&M performance and general asset health.

6.3. Management of ancillary service providers

When the O&M Contractors do not have an all-inclusive contract, Technical Asset Managers may be responsible for managing providers of ancillary (additional) services related to PV site maintenance such as panel cleaning and vegetation management; general site maintenance such as road management, site security; or on-site measurement such as meter readings and thermal inspections. For more information on additional services, please refer to SolarPower Europe’s O&M Best Practice Guidelines Section 6.5, Additional services.

This requires managing a process which spans from tendering for those services all the way to assessing the deliverables and reassuring in coordination with the O&M compliance with environmental, health and safety policies.

6.4. Interface with local energy authorities & regulatory compliance

The Technical Asset Manager is responsible for ensuring that the operation of the PV plant is in compliance with the regulations. Several levels of regulation have to be considered:

- Many countries have a governing law for the operation of energy generating assets or renewable energy and PV plants in particular. This is something the O&M Contractor should be aware of in any case, even if the O&M Contractor and the Technical Asset Manager are separate entities.

- Power Purchase Agreements (PPA) and Interconnection Agreements must also to be known and respected by the Technical Asset Manager.

- Power generation license agreements need to be made available by the Asset Owner to the Technical Asset Manager so that the Technical Asset Manager can ensure compliance with the regulations of these licenses.

- Further to the regulatory compliance, Technical Asset Manager will be responsible to ensure corporate compliance especially on the new post-subsidy environment, which is dictated by corporate PPAs and stricter contractual obligations by the owner.

- Specific regulation for the site such as building permits, environmental permits and regulations can involve certain requirements and the need to cooperate with the local administration. Examples include restrictions to the vegetation management and the disposal of green waste imposed by the environmental administration body, or building permits restricting working time on site or storage of utilities.

- It is the O&M Contractor’s responsibility to ensure grid code compliance. See 5.6. Grid code compliance of the O&M Best Practice Guidelines. It is the responsibility of the Asset Manager to engage the DNO on discussions which will minimise outages and identify measures to safe-guard export capabilities.

- The Technical Asset Manager plays an important role in supporting the cooperation between the aggregator and the grid operator by informing the aggregator about plant production data, unavailable times, transferring network unavailability information from the grid operator, assuming discussions with the grid operator about the attachment to the balancing portfolio of the respective aggregator, and executing plant shutdown requests (in case of negative prices identified in the day-ahead market).

- Other issues requiring formal compliance include reporting of safety plans and incidents, historic/cultural resource protection, noise ordinances that may limit work at night, and any other regulations imposed by an authority having jurisdiction.

As a minimum requirement the agreement between the Technical Asset Manager and the Asset Owner should list all the relevant permits and regulations and specify that the Asset Owner makes relevant documents available to the Technical Asset Manager.

As a best practice, all regulations, permits and stipulations should be managed within the electronic document management system. This allows the Technical Asset Manager to track reporting and maintenance requirements automatically and report back to the Asset Owner or the administration bodies.

6.5. Warranty management

The Technical Asset Manager can act as the Asset Owner’s representative for any warranty claims vis-à-vis the OEM manufacturers of PV plant components. The agreement between the Asset Owner and the Technical Asset Manager should specify warranty management responsibilities of the Technical Asset Manager and the Asset Owner and set thresholds under which the Technical Asset Manager can act directly or seek the Asset Owner’s consent. The Technical Asset Manager or the Operations team will then inform the Maintenance team to perform warranty related works on site. Usually the warranty management scope is limited by Endemic Failures (see definition below in this section). Execution of warranty is often separately billable.

For any warranty claims the formal procedure provided by the warranty provider should be followed. All communications and reports should be archived for compliance and traceability reasons.

Objectives of Warranty Management:

- Improve the efficiency in complaining processes

- Help to reduce the warranty period costs

- Receive and collect all the warranty complaints

- Support the complaint process

- Negotiate with manufacturers more efficient complaint procedures

- Study the behaviour of the installed equipment

- Analyse the costs incurred during the warranty period

Types of warranties on a PV Plant:

- Warranty of Good Execution of Works

- Warranty of Equipment (Product Warranty)

- Performance Warranty

Warranty of good execution of works and equipment warranties

During the warranty period, anomalies can occur in the facility, which the EPC provider is liable for. The anomalies must be resolved according to their nature and classification, in accordance to what is described in the following sections.

The anomalies or malfunctions that might occur within the facility warranty period might be classified in the following way:

- Pending Works, in accordance to the List of Pending Works (or Punch List) agreed with the client during EPC phase;

- Insufficiencies, these being understood as any pathology in the facility resulting from supplies or construction, that although done according to the project execution approved by the client, has proven to be inadequate, unsatisfactory or insufficient;

- Defects, these being understood as any pathology resulting from supplies or construction executed in a different way from the one foreseen and specified in the project execution approved by the client;

- Failure or malfunction of equipment, being understood as any malfunction or pathology found in the equipment of the photovoltaic facility – Modules, Inverters, Power transformers or other equipment.

Anomalies Handling

During the Warranty Period, all the Anomaly processing should, as a best practice, be centralised by the Technical Asset Manager/O&M Contractor, who is responsible for the first acknowledgment of the problem and its framework according to its type and is the main point of contact between the internal organisational structure and the client in accordance to the criteria defined below.

Pending Works, Insufficiencies and Defects

In the case of anomalies of the type “Pending Works”, “Insufficiencies” or “Defects”, the Technical Asset Manager must communicate the occurrence to the EPC provider, who shall be responsible to assess the framework of the complaint in the scope of the EPC contract, determining the action to be taken.

Resolution of failures in the case of anomalies of the type “Failures”

The Technical Asset Manager should present the claim to the equipment supplier and follow the claims process.

Endemic Failures

Endemic failures are product failures at or above the expected failure rates resulting from defects in material, workmanship, manufacturing process and/or design deficiencies attributable to the manufacturer. Endemic failure is limited to product failures attributable to the same root cause.

Performance Warranty

EPC Contractors usually provide a 2-year performance warranty period after the Commercial Operation Date (COD). During the warranty period, it is the responsibility of the Technical Asset Manager to monitor, calculate, report and follow-up the values of Performance Ratio and other KPIs guaranteed by the EPC Contractor.

Within this scope, it is the responsibility of the Technical Asset Manager to:

- Manage the interventions done within the scope of the warranty in order to safeguard the performance commitments undertaken under the contract;

- Periodically inform the Asset Owner about the condition of the contracted performance indicators;

Immediately alert the Asset Owner whenever the levels of the indicators have values or tendencies that could indicate a risk of failure.

Warranty Enforcement

A warranty may be voided by mishandling or not observing instructions or conditions of the warranty. For example, storing modules improperly onsite, such that the packaging is destroyed by rain, may void a warranty. In another case, partial shading of a thin-film module voids the warranty. Failure to provide adequate ventilation may void an inverter warranty. The manufacturer’s warranty might cover replacement but not labour to remove, ship, and re-install an underperforming module. A warranty often gives the manufacturer the option to “repair, replace, or supplement,” with “supplement” meaning to provide modules to make up the difference in lost power. For example, if a system has 10,000 modules that are underperforming by 5%, the guarantor could satisfy the performance warranty by providing 500 additional modules to make up for the lost power, rather than replacing the 10,000 modules. However, increasing the plant size by 500 modules to restore guaranteed power might not be possible due to lack of rack space or electrical infrastructure. Also, expanding the system “nameplate” capacity would generally trigger a new interconnect agreement and permitting. Manufacturers also often have the option of paying a cash-value equivalent to the lost capacity of under-performing modules, but as the price of modules declines, this might be less than originally paid for the modules. Given the complications described above, this option is often preferred by system owners unless there is a required level of performance that must be maintained.

6.6. Insurance claims

The agreement between the Technical Asset Manager and the Asset Owner should specify the insurance management responsibilities of the Asset Owner and the Technical Asset Manager. The Technical Asset Manager will at least be responsible for the coordination of site visits by an insurance provider’s representative or technical or financial advisors in connection with the information collection and damage qualification, as well as for the drafting of technical notes to support the reimbursement procedure. The coordination of the insurance claim and the liaison with the insurers, brokers and loss adjusters, as well as finding the best insurance providers, is usually with the Commercial/Financial Asset Manager (see section 7.14. Suppliers account management).

For any insurance claims, the formal procedure presented by the insurance provider should be followed. All communications and reports should be archived for compliance and traceability reasons.

Types of insurance related to PV plant operations and maintenance include:

- Property insurance, hazard insurance: coverage commensurate with the value of equipment and other improvements to a property; may also cover against other risks if included or unless excluded.

- Commercial general liability insurance: in a form covering all actions by owner or contractors, written on an occurrence basis, including coverage for products and completed operations, independent contractors, premises and operations, personal injury, broad form property damage, and blanket contractual liability. Liability of a fire started by the PV system has increased required liability coverage levels for PV systems. A liability policy should cover negligence claims, settlements, and legal costs too.

- Inland insurance or marine insurance: insures against loss of equipment in shipping or not on the property premises. Inland insurance is often covered under property insurance policy.

- Workmen's compensation: covers costs for employee accidents.

- Professional liability insurance: insures against errors and omissions often required by board of directors.

- Commercial vehicle insurance: insurance for owned and rented vehicles or personal vehicles used on company business

- Warranty insurance: equipment warranty issued by manufacturer but backed up by an insurance company in the event that the manufacturing company goes out of business. Many insurance companies do not offer warranty insurance but rather cover such risk under property insurance.

- Business interruption insurance covers lost revenue due to downtime caused by covered event – this can be important in PPAs where revenue is essential for debt service and O&M expenditures.

- Energy production insurance covers cases when energy production is less than previously specified, which can improve access to debt financing and reduce debt interest rate.

The procedure for making claims described in the insurance policy should be followed to the letter, keeping copies of all submittals and correspondence with the insurance company. The insurance company (claims adjuster) will need to have access to the site provided to them in order to assess damage and to collect the information needed to process the claim.

6.7. Contract management (operational contracts)

Contract management encompasses both technical and commercial/financial aspects. This section looks at contract management from a TAM point of view. Section 7.13. Contract management (financial contracts) takes the perspective of the Commercial/Financial Asset Manager.

The Technical Asset Manager is in charge of ensuring compliance with the operational contracts in place, such as contracts related to O&M services, land lease, insurance, site security, communications and in some cases ancillary (additional) services such as panel cleaning and vegetation control or component procurement. (For more information on procurement, please refer to chapter 8. Procurement).

Indeed, the oversight of and coordination with the O&M Contractor is one of the key responsibilities of the Technical Asset Manager. Thus, the Technical Asset Manager is responsible for performance supervision too: proper oversight of O&M, detecting when systems are underproducing, and quickly and accurately diagnosing an under-performing plant.

The Technical Asset Manager oversees various contractual parameters, responsibilities and obligations of the Asset Owner and the contractual partners linked to the respective solar power plant. Contract management responsibilities depend largely on factors such as geographic location, project size, construction and offtaker arrangements.

As a minimum requirement, the initial step in this process is a comprehensive analysis of the contracts followed by a well-defined Division of Responsibility (DOR) matrix that clearly delineates which entity is responsible for which action on both the short and long term. Upon mutual agreement between the parties, the DOR can serve as the driving and tracking tool for term of life contractual oversight.

As a form of best practice, the Contract Manager’s responsibilities often also extend to functioning as the initial contact for all external questions. This allows the Asset Owner optimal access to all areas of the service provider’s organisation and adherence to the contractual responsibilities. The Contract Manager also assumes the responsibility for invoicing of the O&M fees to the Asset Owner.

For quality purposes, the Technical Asset Manager should also track their own compliance with the respective contract, either O&M contract or Asset Management contract, and report to the Asset Owner in full transparency.

6.8. Asset optimisation (technical)

Technical Asset Managers also start being responsible for providing data and information analysis on assets they manage, as well as to provide asset optimisation solutions, primarily based on the following key areas:

- Plant performance

- Operation cost reduction

- Technology adaptation and upgrades (e.g. Revamping and repowering1)

- Technical People management and training

It is the role of the Technical Asset Manager to initiate and coordinate discussions with both the Owners and the O&M Contractors to future-proof the assets and come up with a financial proposal based on data analysis which can assist the owners in making informed decisions, aiming at enhance production and revenues generation for each site

Note that asset optimisation has commercial and financial aspects too, such as contract optimisation, presented in chapters 7. Commercial and Financial Asset Management and 8. Procurement.

1 For detailed information about revamping and repowering, please refer to chapter 7. Revamping and Repowering of the O&M Best Practice Guidelines.

6.9. Revamping & repowering

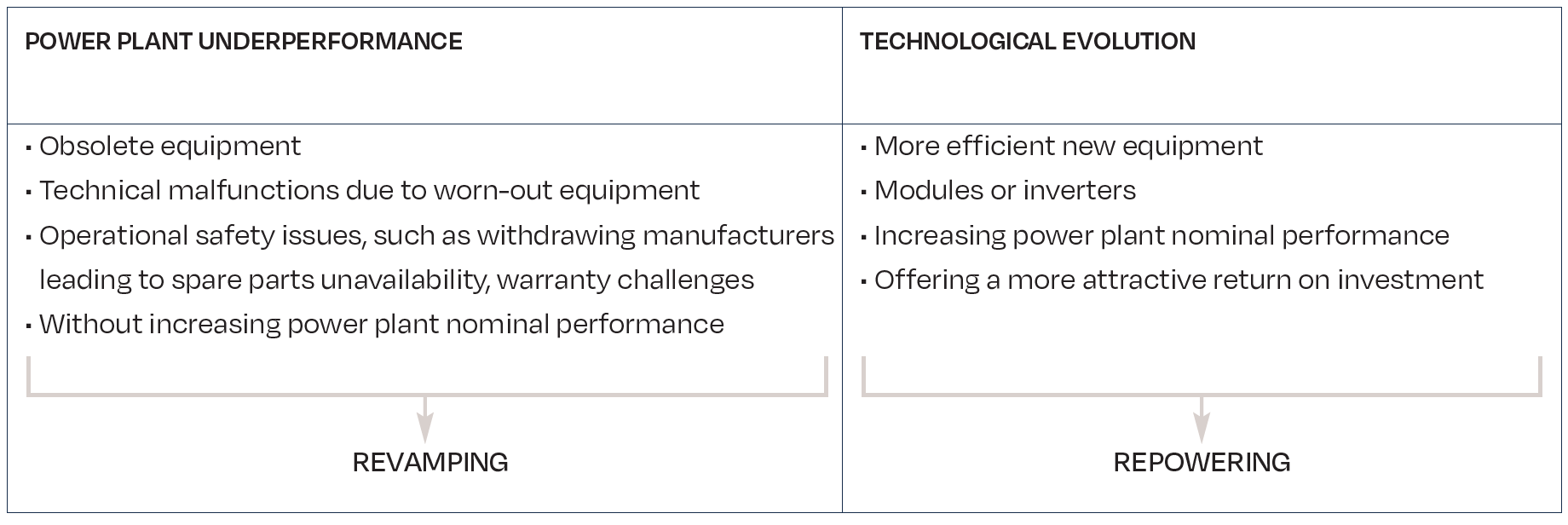

Revamping and repowering are considered market trend optimisation strategies due to their main drivers: component failure or underperformance; ageing of solar assets; unavailability of spare parts and support; technological improvements; higher efficiency production rates due technological evolution; decreasing prices and additional benefits (such as new warranty terms). The increased efficiency and declining component prices of solar technology translates in an opportunity to boost asset performance, optimise operation cost and increase the revenue stream.

For the Asset Manager and Asset Owner a revamping or repowering project needs to be considered as a commercial and financial re-investment case. Thus, a revamping or repowering case starts under at least one of the following conditions:

In order to evaluate the business case, the Technical Asset Manager should perform a complete assessment of equipment preservation and correspondent performance levels (actual versus budget/expected).

The focus of revamping or repowering considerations is on PV modules and inverters when either all, or parts of these components get replaced. Other parts of the PV plant may undergo revamping as well, usually this is a by-product of the replacement of the main components.

The following dimensions need to be evaluated when considering plant repowering

a. Regulatory aspects

b. Commercial viability

c. Technical feasibility

There are implications from decisions made along one dimension to the other dimension, thus the commercial planning of a repowering projects is an iterative process.

a. Regulatory aspects

Regulatory aspects can only be covered very briefly in this context, as they are highly specific to the type of power plant and the jurisdiction it operates in. It is not unusual that a repowered power plant needs to fulfil current regulation whereas the existing power plant only needs to fulfil regulation as required at the time of commissioning. This may result in additional technical requirements with severe commercial implications, if omitted.

The following regulatory fields heavily influence the feasibility of a power plant repowering project:

Technical regulation

Many jurisdictions have tightened the technical requirements a power plant needs fulfil over time. The most important considerations are:

- Conformity with regulations regarding the power network. This may include technical quality parameters of the feed-in power, remote power control, protection equipment, among others

- Certification of the components used

- Emission control (EMV emission, acoustic emission)

Feed-in tariff regulation, off-take agreements

Power plants operated based on a feed-in tariff (or that are otherwise subsidized) need to take in account the details of the subsidy scheme the plant is intended to operate. Replacing major components risks losing the feed-in tariff as a worst-case scenario. This is especially important if the nominal power of the plant is changed. A detailed legal opinion is advisable if PV modules are replaced. Private off-take agreements need to be reviewed as well, to eliminate risk of contractual breach.

Building permits, municipal and environmental regulation

Building permits may include obligations to the plant operator that may impede or influence repowering projects. The operator should revisit the corresponding documentation in detail.

b. Commercial viability

Most repowering initiatives arrive from commercial ambitions, aiming at higher future revenues or offsetting production losses. Even in cases revamping or repowering is motivated by technical improvement, such as eliminating safety issues, the asset manager should search for opportunities of commercial improvement as side-effect.

Asset Managers target older PV plants, to perform revamping and repowering projects, as they have higher incentives and potential for higher IRRs (internal rate of return) associated with FIT (feed-in-tariff) subsidy regimes. These PV plants have a higher probability of problems with components defects and plant underperformance, due component ageing and quality issues arising from the rush to meet FIT deadlines. Consequently, the opportunity for site optimization is higher in projects with more than ten years of age and FIT subsidy regimes. Hence, Asset Managers have a clear incentive to target this type of solar assets for site optimization.

It is the Asset Manager responsibility to build a solid business case to assess project viability. The analysis must contain historical asset performance, future performance, revenues, costs, extended life span, changes in maintenance requirements (O&M contract revision), changes in land lease requirements (contract revision) and changes in PV Plant technical layout in order to be able to forecast future income streams. Additionally, a risk assessment and sensibility analysis must be made.

The following commercial parameters should be considered in the calculations during the decision-making process:

- Investment cost

- Plant downtime and production loss during repowering project

- Yield improvement by increased component efficiency or increased nominal power

- Changes in expected operating downtime with improved equipment

- Changes in maintenance cost (preventive and reactive)

- Financing cost

- Cost of equity capital

- Forecast future revenues

In addition, following factors need to be included in the decision-making process. When quantification is not reliably possible, the commercial effect needs to be based on the judgement of the operator:

- Project risk (delay, excess cost)

- Operation risk (safety)

- Compatibility with existing processes of plant operation

- Changes in component warranty

c. Technical feasibility

See Chapter 7. Revamping and repowering of the O&M Best Practice Guidelines for considerations of technical feasibility (SolarPower Europe, 2020).

6.10. Environmental management

Depending on local and international environmental regulations, as well as on the Asset Owner’s CSR and Environmental internal policies, the Asset Owner may have incentives to reduce or control negative environmental impacts.

An increasing body of scientific evidence indicates that well-designed and well-managed solar energy can support wildlife habitats and contribute significantly to national biodiversity targets. In fact, solar parks can have several additional advantages over other agricultural landscapes, in that they are secure sites with minimal human and technical disturbance from construction, require little or no use of chemical pesticides, herbicides or fertilizers, and typically incorporate ecological features such as drainage ponds and hedgerows, which can be designed to maximise the value of their habitat.

The approach to managing biodiversity will be different for every solar park, and it is recommended that a site-specific plan be devised in each case.

Therefore, the Asset Manager is obliged to assess the impact or limitations of environmental legislation on the supplier’s existing contracts. Furthermore, the Asset Manager is required to develop an action plan to address existing problems and minimise their impact.

As an example, the Asset Manager must oversee the O&M provider’s operational field work to ensure compliance with local environmental regulation (use of chemicals to control vegetation, use of diesel cutting machines, etc.); the security contract must be adapted, if possible, according to the wild life existing around the photovoltaic plant and the appropriate security equipment, such as loudspeakers, spotlights and fences, must also be adapted.

Long-term environmental requirements can also include water tank installation, tree clearing, installation of drainage systems, amphibian follow-up, edge plantation, and installation of reptile rock shelters. As a best practice, the Technical Asset Manager’s (or the O&M Contractor’s) environmental preservation activities should go beyond legal obligations.

6.11. Health & Safety management

The Technical Asset Manager should oversee that the solar asset and the relevant suppliers comply with health & safety (H&S) requirements. If necessary, the Technical Asset Manager should hire an H&S expert to ensure compliance. For more information, see chapter 2. Environment, Health & Safety of the O&M Best Practice Guidelines.

6.12. Challenges of multi-jurisdictional and global portfolios

The principles of a robust technical management should be deployed consistently across markets, jurisdictions and territories to ensure efficiency and effectiveness of asset management activities. However, the key tasks carried out as part of the technical asset management may require adaptation to the peculiarities of different markets and jurisdictions. The approach to successfully managing assets across varied territories must start with centralized strategies which are underpinned by company policy and standards. The aim is to create economies of scale and consistency to approach which still allow the AM service to be adaptable to the nuances of the territory.

| TECHNICAL AM ACTIVITIES | MULTI-JURISDICTIONAL CHALLENGES |

| Technical reporting | For AM service providers with well established data management and reporting practice, the location of sites in multiple and different jurisdiction should be essentially neutral. Aggregation of sites and centralized data management must developed to assist the Owner preferred view of the international portfolio |

| Site visits and non-intrusive inspections | Local presence will be required to ensure this service is carried out suitably. However, areas of focus during the visit, the assessment criteria and required evidence, remain quite consistent from jurisdiction to jurisdiction. Certain specific inspections (for instance drone inspections and subsequent analysis) can be carried out by the same specialist providers across multiple jurisdictions, greatly increasing the value of the larger international data set. |

| Management of ancillary service providers | Local knowledge of the market might be required to the extent the Owner and AM service providers have decided to appoint local contractors. |

| Interface with local energy authorities & regulatory compliance | This task requires specific local knowledge to be fulfilled appropriately. Regulatory requirements and electricity market requirements are very country specific (even though in general compliance with European legislation), therefore the AM services providers must invest in specific knowledge and skills to ensure suitable understanding of reporting deadlines and compliance requirements are adhered to |

| Warranty management | This task and function can be centralized, together with the review of the spare parts strategy. Centralization generally allows to benefit of economies of scale and the deployment of best practices learnt in a jurisdiction to the rest of the portfolio. Legal enforcement of warranties will require dedicated legal advice depending on the jurisdiction of each warranty and the overarching supply/EPC/O&M contract. |

| Insurance claims | This task and function can be centralized to the extent the AM service provider can invest in insurance specialists. Operational portfolios spread over multiple jurisdictions tend to be aggregated in global insurance and risk management programs, whilst there might be specific insurance terms driven by specific jurisdictions, consistency of coverage is achievable for the benefit of the Owners |

| Contract management (operational contracts) | Local knowledge of the market might be required to the extent the Owner and AM service providers have decided to appoint local contractors. Centralization will however increase the level of efficiency and control to the extent the general risk allocation set forth by the contracts is relatively consistent across jurisdictions. This is particularly relevant if the Owner has deployed an international EPC/O&M contract strategy, with a selected number of international contractors. Legal enforcement of contracts will require dedicated legal advice depending on the jurisdiction of each warranty and the overarching supply/EPC/O&M contract. |

| Asset optimisation (technical) | This task and function can be centralized, together with the lesson learnt and feedback loop process, described in Chapter 3. This will allow deployment of best practices learnt in a jurisdiction to the rest of the portfolio and ensure effective PV sites peer to peer comparison. |

| Environmental management | Similar implications as to the local authorities and regulatory compliance. Local knowledge of climate, flora and fauna can be vital in how an asset is managed with in a particular setting. However, experience with successful environmental management plans in different territories can provide useful opportunity to enhance biodiversity in other jurisdictions, facilitation international deployment of best practices |

| Health & Safety management | Similar implications as to the local authorities and regulatory compliance. |

TABLE 12 - TECHNICAL ASSET MANAGEMENT: CHALLENGES OF MULTI-JURISDICTIONAL AND GLOBAL PORTFOLIOS